tusfrases.ru

Learn

Umc Stock Buy Or Sell

Based on the United Microelectronics Corporation stock forecast, it's now a bad time to buy UMC stock because it's trading % above our forecast, and it. buying or selling United Microelectronics, making its price go up or down On the other hand, investors will often sell stocks at prices well below. United Microelectronics Corporation (UMC) currently has an average brokerage recommendation (ABR) of on a scale of 1 to 5 (Strong Buy to Strong Sell). Get United Microelectronics Corp (UMC:NYSE) real-time stock quotes, news, price and financial information from CNBC selling or sharing/processing data such as. buy or sell a security. The information on this site, and in its related newsletters, is not intended to be, nor does it constitute investment advice or. Is United Microelectronics Stock a Buy? · United Microelectronics share price is while UMC 8-day exponential moving average is , which is a Sell signal. 3 analyst ratings · buy 67% · hold 0% · sell 33%. Analyst Ratings. Sell; Under; Hold; Over; Buy. Number of Ratings 3 Full Ratings. Recent News. MarketWatch. Dow Jones. Read full story. Chips Taiwan Earthquake. United Microelectronics has received a consensus rating of Moderate Buy. The company's average rating score is , and is based on 2 buy ratings, 1 hold. Based on the United Microelectronics Corporation stock forecast, it's now a bad time to buy UMC stock because it's trading % above our forecast, and it. buying or selling United Microelectronics, making its price go up or down On the other hand, investors will often sell stocks at prices well below. United Microelectronics Corporation (UMC) currently has an average brokerage recommendation (ABR) of on a scale of 1 to 5 (Strong Buy to Strong Sell). Get United Microelectronics Corp (UMC:NYSE) real-time stock quotes, news, price and financial information from CNBC selling or sharing/processing data such as. buy or sell a security. The information on this site, and in its related newsletters, is not intended to be, nor does it constitute investment advice or. Is United Microelectronics Stock a Buy? · United Microelectronics share price is while UMC 8-day exponential moving average is , which is a Sell signal. 3 analyst ratings · buy 67% · hold 0% · sell 33%. Analyst Ratings. Sell; Under; Hold; Over; Buy. Number of Ratings 3 Full Ratings. Recent News. MarketWatch. Dow Jones. Read full story. Chips Taiwan Earthquake. United Microelectronics has received a consensus rating of Moderate Buy. The company's average rating score is , and is based on 2 buy ratings, 1 hold.

(UMC) stock prices, quotes, historical data, news, and Insights for informed trading and investment price that an investor is willing to buy or sell a stock. United Microelectronics Corporation (UMC) Frequently Asked Questions. Is United Microelectronics Corporation (UMC) a buy, sell, or hold? 5 analysts have. Is UMC a Buy, Sell or Hold? Counts: 3 bullish, 0 bearish and 2 neutral indicators. You may wish to incorporate that into your trading strategies. Recent News. United Microelectronics Corp. ADR analyst ratings, historical stock prices, earnings estimates & actuals. UMC updated stock price target summary. In the current month, UMC has received 1 Buy Ratings, 2 Hold Ratings, and 2 Sell Ratings. UMC average Analyst price target in the past 3 months is ―. 3M Ago1M AgoCurrent. Buy. 2. 2. Overweight. 0. 0. Hold. 1. 0. Underweight. 1. 1. Sell. 0. 0. ConsensusBuyBuy. Stock Price Target. High, $ Low, $ The average one-year price target for United Microelectronics Corporation - Depositary Receipt (Common Stock) is $ The forecasts range from a low of $ Based on 3 Wall Street analysts who have issued ratings for United Microelectronics in the last 12 months, the stock has a consensus rating of "Moderate Buy.". $ · UMC is trading DOWN -$ or % from yesterday's close of $ · Right now UMC is $ below high of day. Barchart Opinion ; 50 - Day MACD Oscillator, Buy ; 50 - Day Average Volume: 11,,, Average: 50% Buy ; Long Term Indicators ; Day Moving Average, Sell. Considering the day investment horizon and your above-average risk tolerance, our recommendation regarding United Microelectronics is 'Hold'. Macroaxis. Find the latest United Microelectronics Corporation (UMC) stock quote Sell. Analyst Price Targets. Low. Average. Current. High. View. To decide if United Microelectronics Corp (ADR) stock is a buy or sell, you'll want to evaluate its fair market price or intrinsic value. Buying stocks that are. Dividend Six? Wired. Plain vanilla investors fawn over chipmakers and AI stocks. They hope they can buy them high, and sell them higher. Other symbols. According to our live Forecast System, United Micro Electronics - ADR stock is a bad long-term (1-year) investment*. "UMC" stock predictions are updated every 5. The chip foundry is expected to enjoy strong capacity utilization for the next few quarters. 3 Top Tech Stocks Under $20 Per Share. Anders Bylund | Jan 14, View analyst opinion as to whether the stock is a strong buy, strong sell or hold, based on analyst Month UMC price targets. Created with Highcharts View the real-time UMC price chart on Robinhood and decide if you want to buy or sell commission-free. Other fees such as trading (non-commission) fees. UMC vs Semiconductor Stocks ; $, $, +%, Buy ; $, $, +%, Hold. Detailed Analyst Forecast >. Technical Analysis. 1 Day. 3 Days. 1 Week. 1 Month. Overall Consensus. Created with Highcharts Strong Sell Strong Buy.

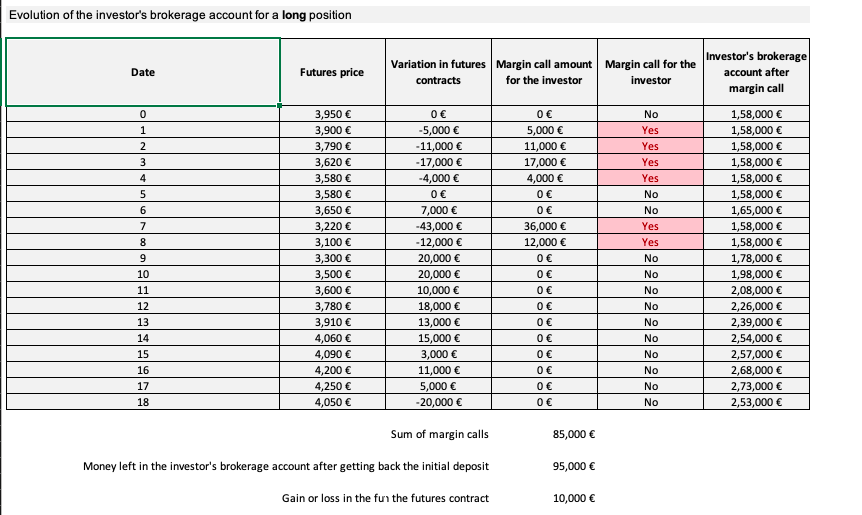

Initial And Maintenance Margin

An initial margin is the minimum amount of capital required to open a position for a specific asset. Since the account balance may fluctuate based on the profit. Initial Margin (IM): The initial deposit of collateral required by a broker Maintenance Margin (MM): The minimum amount of equity that must be. The maintenance margin is the required percentage of the total investment that is less than the initial margin, and which the investor must maintain in their. FINRA Rule requires that you maintain a minimum of 25% equity in your margin account at all times. Most brokerage firms maintain margin requirements that. As set forth in paragraphs (b) and (c) of this Rule, the minimum initial and maintenance margin levels for each security futures contract, long and short, shall. Initial margin is the amount of margin required when a futures position is opened. Maintenance margin is the minimum amount of equity that must be maintained in. In addition to initial margin, there's also maintenance margin. Maintenance margin is lower than initial margin. Typically, the initial margin requirement. The producer posts initial margin of. $5, ($2,/contract * 2 contracts) with a futures commission merchant. The maintenance margin level will be $3, ($. Initial margin needs are not the same as maintenance margin requirements, which refer to the minimum percentage of equity that needs to be kept in the account. An initial margin is the minimum amount of capital required to open a position for a specific asset. Since the account balance may fluctuate based on the profit. Initial Margin (IM): The initial deposit of collateral required by a broker Maintenance Margin (MM): The minimum amount of equity that must be. The maintenance margin is the required percentage of the total investment that is less than the initial margin, and which the investor must maintain in their. FINRA Rule requires that you maintain a minimum of 25% equity in your margin account at all times. Most brokerage firms maintain margin requirements that. As set forth in paragraphs (b) and (c) of this Rule, the minimum initial and maintenance margin levels for each security futures contract, long and short, shall. Initial margin is the amount of margin required when a futures position is opened. Maintenance margin is the minimum amount of equity that must be maintained in. In addition to initial margin, there's also maintenance margin. Maintenance margin is lower than initial margin. Typically, the initial margin requirement. The producer posts initial margin of. $5, ($2,/contract * 2 contracts) with a futures commission merchant. The maintenance margin level will be $3, ($. Initial margin needs are not the same as maintenance margin requirements, which refer to the minimum percentage of equity that needs to be kept in the account.

There are 2 levels of margins: the initial margin and the maintenance margin. A margin call is required once an account's initial margin has been reduced to. Margin requirements. There are two types of margin – variation margin (VM) and initial margin (IM). The methodologies for calculating the amounts of margin. Minimum maintenance helps ensure customer margin accounts don't spiral out of control if the market moves against them. Additionally, they help protect the. Margin requirements. There are two types of margin – variation margin (VM) and initial margin (IM). The methodologies for calculating the amounts of margin. According to Regulation T of the Federal Reserve Board, the Initial Margin requirement for stocks is 50%, and the Maintenance Margin Requirement is 25%, while. Margin maintenance is the minimum portfolio value (excluding any crypto positions) that you need to prevent a margin call. Intraday Initial, Intraday Maintenance, Long Overnight Margin, Short Overnight Margin, Long Maintenance Margin, Short Maintenance Margin, Intraday Rate. In stocks, you can borrow against your assets like a loan. In futures, you put down a good faith deposit called the initial margin requirement. The cash for the. This agreement stipulates the minimum or initial margin of at least $ that the account must have in cash or securities before investors can make trades. Initial Margin (IM): The initial deposit of collateral required by a broker Maintenance Margin (MM): The minimum amount of equity that must be. Initial margin is the amount required by the exchange to initiate a futures position. While the exchange sets the margin amount, your broker may be required to. Initial margin is what' s required to open the trade. Maintenance margin is what's required to keep the trade open. As set forth in paragraphs (b) and (c) of this Rule, the minimum initial and maintenance margin levels for each security futures contract, long and short, shall. Intraday Margin rates are effective from the product open until 15 minutes prior to the session close when Initial Margin is required. Initial Margins are. FINRA Rule (Margin Requirements) describes the margin requirements that determine the amount of collateral customers are expected to maintain in their. Initial Margin. Initial margin is the cash deposit required to be put forward when opening a new futures position which is determined based on a percentage of. Margin Maintenance and Initial Margin are key factors in diversifying a trading portfolio. When traders manage their margins effectively, they can allocate. Learn the difference between initial and maintenance margin requirements. Find out how trading on low margin with high leverage attracts many. Variation margin – the other type of collateral – is paid daily from one initial margin. If we assume that the initial maintenance margin requirement is 50% of the purchase price of the trade, the investor must maintain a balance of half of the.

The Best Small Business Checking Account

Grow your small business with the best business bank account for you. BMO has a range of business chequing and savings accounts to fit your size and. Truist Simple Business Checking. Straightforward—with no monthly maintenance fee. Perfect if you're just starting out. Our picks for the best small-business checking accounts include American Express, Chase, Bank of America, Bluevine, LendingClub, NBKC, Relay and more. Novo is an online business banking platform with no hidden fees built for small business owners. Apply for a free Novo checking account. Welcome to Small Business Bank, home of FREE Business Checking. Open an account from anywhere in the US with no transaction limits and no minimum balance. Capital One is a good option for small business banking. The downsides of Capital One is that you have to open an account at a physical branch, and that they. Explore our checking accounts. Simplified Business Checking. A basic checking account for small businesses with low to moderate monthly transaction volumes. Business accounts you need to succeed ; Silver Business Checking Package. Best for new or small businesses with basic banking needs. $0 monthly maintenance fee. TD Small Business Bank Accounts offer a variety of features tailored to help you manage & grow your business. Find the right business bank account for you. Grow your small business with the best business bank account for you. BMO has a range of business chequing and savings accounts to fit your size and. Truist Simple Business Checking. Straightforward—with no monthly maintenance fee. Perfect if you're just starting out. Our picks for the best small-business checking accounts include American Express, Chase, Bank of America, Bluevine, LendingClub, NBKC, Relay and more. Novo is an online business banking platform with no hidden fees built for small business owners. Apply for a free Novo checking account. Welcome to Small Business Bank, home of FREE Business Checking. Open an account from anywhere in the US with no transaction limits and no minimum balance. Capital One is a good option for small business banking. The downsides of Capital One is that you have to open an account at a physical branch, and that they. Explore our checking accounts. Simplified Business Checking. A basic checking account for small businesses with low to moderate monthly transaction volumes. Business accounts you need to succeed ; Silver Business Checking Package. Best for new or small businesses with basic banking needs. $0 monthly maintenance fee. TD Small Business Bank Accounts offer a variety of features tailored to help you manage & grow your business. Find the right business bank account for you.

Apply for a Business Checking Account online with First Internet Bank – because why not choose the best small business checking account? Best Small Business Checking Accounts for · Quick Comparison · U.S. Bank: Best for Free Checking & Low Transaction Volumes · Chase: Best for Full-service. Simplify your small business banking and help your company grow with Bank of America Business Advantage. Open a business bank account, find credit cards. Small Business Checking & Savings · Entrepreneur Checking. Designed for businesses just starting out, this account grows as you grow. · Business Community. 7 Best Business Bank Accounts in Canada · RBC Flex Choice Business Account · Wealthsimple Save For Business Account · RBC Digital Choice Business Account · CashBack. Banks for small businesses · Wells Fargo: Best bank for branch and ATM access · Bluevine: Best bank for business checking · Live Oak Bank: Best bank for business. Whether you are a small, medium or large business, Chase has business checking accounts that accept mobile payments, handle transactions. Business Basic Checking · No Minimum Balance · Free Visa Debit Card · No Monthly Service Fee · Checks Paid – $ per check (first 75 free) · Checks Deposited –. Your Small Business Checking Account should match the way you bank. Commerce Best for businesses with light to moderate transaction volume. This. Chase Bank is our top pick for small business banking. It offers many positive features, including a signing bonus, easy cash deposits, cash-back reward cards. Business checking accounts designed to move your business forward with financial tools, services and dedicated support, all in one place. For the ambitious business owner seeking a stable foundation, Initiate Business Checking gives you digital tools and support you can count on. It's designed for. All your business checking account needs from cash flow management to more complex transactions—covered. Find out how Capital One business checking accounts. Business Advisor Checking® A relationship account that's perfect for businesses with average account activity. Up to check transactions per statement. A relationship-based checking account for business owners and executives with checking accounts at CIBC. No monthly maintenance fee when you maintain an average. PNC Bank offers several business checking accounts to fit the needs of your small business. Find the right checking account for your company. Open an online business checking account easily with Spring Bank. Call now to get one of the best checking accounts for business out there. We'll focus on Chase Business Complete Checking as one of the best small business checking accounts since it has low monthly fees and powerful eBanking. Bluevine's small business checking account comes with no monthly fees and a % APY rate for eligible customers. Learn how to open an account today.

Mfs Moderate Allocation Fund A

The fund seeks a high level of total return consistent with a moderate level of risk relative to the other funds in the MFS target-risk series. View 13F filing holders of MFS Moderate Allocation Fund-R4. 13F filings are submitted quarterly to the SEC by hedge funds and other investment managers. MFS Moderate Allocation A MAMAX · NAV / 1-Day Return / − % · Total Assets Bil · Adj. Expense Ratio. % · Expense Ratio % · Distribution. The investment seeks a high level of total return consistent with a moderate level of risk relative to the other MFS Asset Allocation Funds. The fund is. Performance charts for MFS Moderate Allocation Fund (MAMAX) including intraday, historical and comparison charts, technical analysis and trend lines. Get MFS Moderate Allocation Fund Class A (MAMAX:NASDAQ) real-time stock quotes, news, price and financial information from CNBC. The investment seeks a high level of total return consistent with a moderate level of risk relative to the other MFS Asset Allocation Funds. MAMAX Performance - Review the performance history of the MFS Moderate Allocation A fund to see it's current status, yearly returns, and dividend history. The fund is designed to provide diversification among different asset classes by investing its assets in other mutual funds advised by the adviser referred. The fund seeks a high level of total return consistent with a moderate level of risk relative to the other funds in the MFS target-risk series. View 13F filing holders of MFS Moderate Allocation Fund-R4. 13F filings are submitted quarterly to the SEC by hedge funds and other investment managers. MFS Moderate Allocation A MAMAX · NAV / 1-Day Return / − % · Total Assets Bil · Adj. Expense Ratio. % · Expense Ratio % · Distribution. The investment seeks a high level of total return consistent with a moderate level of risk relative to the other MFS Asset Allocation Funds. The fund is. Performance charts for MFS Moderate Allocation Fund (MAMAX) including intraday, historical and comparison charts, technical analysis and trend lines. Get MFS Moderate Allocation Fund Class A (MAMAX:NASDAQ) real-time stock quotes, news, price and financial information from CNBC. The investment seeks a high level of total return consistent with a moderate level of risk relative to the other MFS Asset Allocation Funds. MAMAX Performance - Review the performance history of the MFS Moderate Allocation A fund to see it's current status, yearly returns, and dividend history. The fund is designed to provide diversification among different asset classes by investing its assets in other mutual funds advised by the adviser referred.

See the quotes that matter to you, anywhere on tusfrases.ru Start browsing Stocks, Funds, ETFs and more asset classes. A high-level overview of MFS Moderate Allocation Fund A (MAMAX) stock. Stay up to date on the latest stock price, chart, news, analysis, fundamentals. MAMAX: MFS Moderate Allocation Fund - Class A - Fund Performance Chart. Get the lastest Fund Performance for MFS Moderate Allocation Fund - Class A from. Get the latest MFS Moderate Allocation Fund Class A (MAMAX) stock price quote with financials, statistics, dividends, charts and more. MAMAX - MFS Moderate Allocation Fund ; YTD Return, % ; Expense Ratio (net), % ; Category, Allocation% to 70% Equity ; Last Cap Gain, ; Morningstar. The MFS Moderate Allocation Fund Class R3 (MAMHX) is a mutual fund that aims to provide a balanced investment approach by allocating its assets across a. Find our live Mfs Moderate Allocation Fund Class A fund basic information. View & analyze the MAMAX fund chart by total assets, risk rating, Min. investment. MFS Moderate Allocation Fund seeks a high level of total return consistent with a moderate level of risk relative to the other MFS Asset Allocation Funds. The. The fund is designed to provide diversification among different asset classes by investing its assets in other mutual funds advised by MFS (Massachusetts. View the latest MFS Moderate Allocation Fund;A (MAMAX) stock price, news, historical charts, analyst ratings and financial information from WSJ. The MFS MARRX Moderate Allocation Fund summary. See MARRX pricing, performance snapshot, ratings, historical returns, risk considerations, and more. The investment seeks a high level of total return consistent with a moderate level of risk relative to the other MFS Asset Allocation Funds. The fund is. Fund Performance. The fund has returned percent over the past year, percent over the past three years, percent over the past five years and Objective. The investment seeks a high level of total return consistent with a moderate level of risk relative to the other MFS Asset Allocation Funds. The. Get MAMAX mutual fund information for MFS-Moderate-Allocation-Fund, including a fund overview,, Morningstar summary, tax analysis, sector allocation. Trailing total returns ; Moderate Allocation, +%, +% ; S&P TR USD, +%, +% ; Fund quartile, 3rd, 4th ; Funds in category, , MFS MODERATE ALLOCATION FUND CLASS R4- Performance charts including intraday, historical charts and prices and keydata. Complete MFS Moderate Allocation Fund;R1 funds overview by Barron's. View the MAMFX funds market news. News and analysis for professional fund investors across the USA. Performance charts for MFS Moderate Allocation Fund (EAMDX) including intraday, historical and comparison charts, technical analysis and trend lines.

What Is The Most Reliable Trail Camera

I've settled on the Reconyx XR6. Very dependable, great sound and video quality, and built like tanks (lots of curious bears and the occasional bad guy in my. The Best Cellular Trail Cameras of , Tested and Reviewed. This year's crop of cellular trail cameras is better than ever. We put the latest models to the. Monitor your herd with America's most dependable trail cameras · Mirage™ 22 · ORBIT º · Kicker Lightsout™ · Kicker · Shadow 26MP Lightsout Combo. Find the best Spypoint trail cameras and cellular trail cameras for your needs and get the most out of it. Whether you are a beginner or an avid hunter. Best seller. SUNOYAR Mini Game Camera, 20MP P HD Trail Camera with Night Vision, Wildlife Waterproof. Black, variant on SUNOYAR Mini Game Camera, 20MP. Infrared Cameras · Infrared cameras are easy to install and can be managed without a lot of work. These cameras are extremely weather-proof since they were. Browning Trail Cameras now offers you a full line of trail cameras and related accessories to help you capture great images of the game on your property. VOOPEAK Solar Trail Camera 4K 48MP, Forever Power, Game Wildlife Hunting Waterproof Outside Cameras, s Trigger Time with ° Detection Angle Night Vision. 65/ Wosports G Pro. Wosports G Trail Camera is dirt cheap and perhaps, one of the best values on today's market. The camera is capable of 30MP photos. I've settled on the Reconyx XR6. Very dependable, great sound and video quality, and built like tanks (lots of curious bears and the occasional bad guy in my. The Best Cellular Trail Cameras of , Tested and Reviewed. This year's crop of cellular trail cameras is better than ever. We put the latest models to the. Monitor your herd with America's most dependable trail cameras · Mirage™ 22 · ORBIT º · Kicker Lightsout™ · Kicker · Shadow 26MP Lightsout Combo. Find the best Spypoint trail cameras and cellular trail cameras for your needs and get the most out of it. Whether you are a beginner or an avid hunter. Best seller. SUNOYAR Mini Game Camera, 20MP P HD Trail Camera with Night Vision, Wildlife Waterproof. Black, variant on SUNOYAR Mini Game Camera, 20MP. Infrared Cameras · Infrared cameras are easy to install and can be managed without a lot of work. These cameras are extremely weather-proof since they were. Browning Trail Cameras now offers you a full line of trail cameras and related accessories to help you capture great images of the game on your property. VOOPEAK Solar Trail Camera 4K 48MP, Forever Power, Game Wildlife Hunting Waterproof Outside Cameras, s Trigger Time with ° Detection Angle Night Vision. 65/ Wosports G Pro. Wosports G Trail Camera is dirt cheap and perhaps, one of the best values on today's market. The camera is capable of 30MP photos.

"The Camojojo birdwatching camera is the most satisfying gift I've received this year! The incredibly high-definition quality left me in awe. With the powerful. The most reliable trail camera is the Browning Strike Force Pro XD. most reliable trail camera. Related technologies: 1. High-Quality Image. No matter what type of camera you use – an old favorite or the newest high tech setup – these steps can help you position the cameras for the best results. The best cellular trail camera can provide real-time insights and an immersive experience like never before. I have and use a Campark T You can check my videos and the quality is fantastic compared to most other trailcams I have used. Moultrie. Cellular trail cameras are a versatile tool to photograph game. Learn about the benefits of cellular trail cams and the best Browning models to buy. The Bushnell Core DS-4K No Glow is the best trail camera of , thanks to its high resolution, no-glow flash, detection range, recovery time, and ease of use. Stealth Cam's all-new Revolver™ Degree Cellular Trail Camera delivers the equivalent of six cameras worth of coverage in a single device—capturing. THE NEXT GENERATION Since , RECONYX has been designing and manufacturing the best performing, most reliable trail cameras available. First Time Trailcam Buyer's Guide ; Picture Quality: View sample photos from all the popular camera traps. ; Setup & Viewing Screen: It's easy to learn how to. Choosing the right one is no easy task. However, if you consider the following options you are sure to find the best trail cameras for you. When you demand the best battery life for your cellular trail camera, choose Herd and Amped Outdoors. SHOP · BROWNING. Browning Trail Cameras are designed. Top 5 Wireless Trail Cams · Browning Defender Vision Dual Sim Cellular Trail Camera 20 MP · Spartan Camera GoCam Blackout Cellular Trail Camera 8 MP · TACTACAM. Trail Cameras Guide · The best hunting trail cameras. · CORE™ S-4K No Glow Trail Camera · CORE™ DS-4K No Glow Trail Camera · CelluCORE™ 20 Solar Cellular Trail. I have been running Stealth Cam cell cameras for 2 years and the Fusion Max is the best bang for the buck in my opinion. Battery life on this particular model. Whether you're looking for your first trail camera or adding another to your scouting stable, you'll appreciate that Bass Pro Shops carries all the top brands. NEW - Introducing the all new RivalA5! Our best selling and most reliable cellular trail camera just got better! · Improved Image Quality With Updated. Traditional trail cameras save images on an SD card which you can physically retrieve to view. One of the most popular traditional game cams is the Bushnell. The Defender Pro Scout Max Extreme HD cellular trail camera from Browning is here to CHANGE THE GAME! If you are looking for more detail in your cell cam.

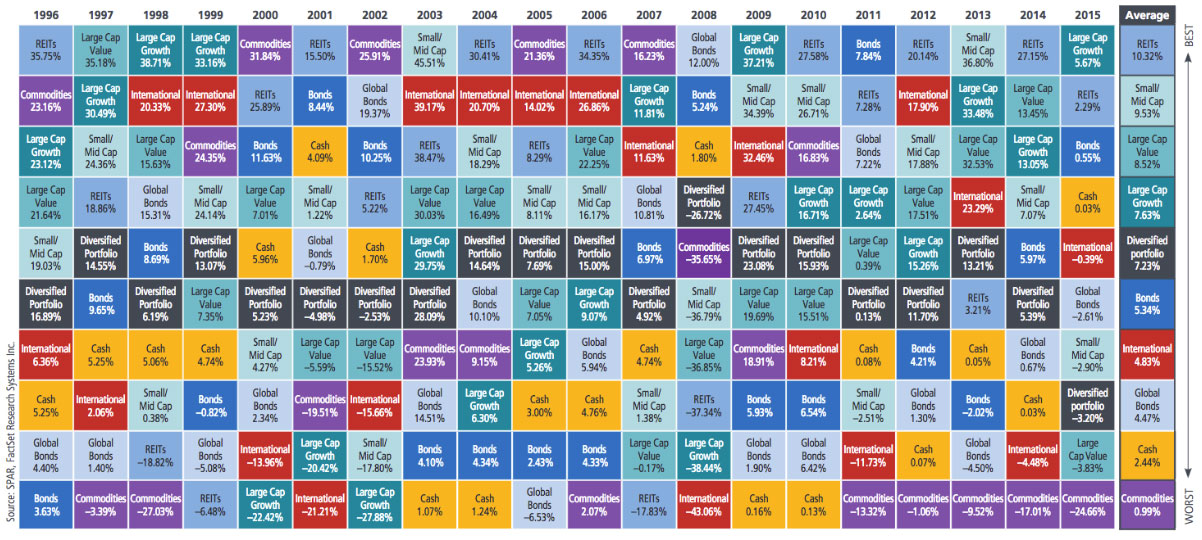

Easy Investment Options

There are many ways to build wealth, and passive income is a simple one. Learn all about passive income and how you can start building wealth today. Publicly. Mutual funds are professionally managed, diversified investments that make it easy to access market growth. Equity, balanced, bond and money market funds — we. What kind of investor are you? Answer a few questions and we'll give you the best investing options based on your goals, risk tolerance, & investing style. Invest in Canada offers tailored services that make it easier to choose Canada for your next business expansion. Self-directed investing. Easy-to-use tools for buying and selling stocks, ETFs, and more; Resources to build a portfolio, research investments, and discover new. An easy and flexible way to invest · Compare ways to invest. Find an investment option that works for you Investing strategies and insights. Retirement. TD Direct Investing offers investment options that include stocks, ETFs, mutual funds, GICs, fixed income investments, and options trading. ETFs and mutual funds are pooled investments comprising stocks, bonds, and other funds, providing a single diversified investment. The difference between the. A cash bank deposit is the simplest, most easily understandable investment asset—and the safest. It not only gives investors precise knowledge of the interest. There are many ways to build wealth, and passive income is a simple one. Learn all about passive income and how you can start building wealth today. Publicly. Mutual funds are professionally managed, diversified investments that make it easy to access market growth. Equity, balanced, bond and money market funds — we. What kind of investor are you? Answer a few questions and we'll give you the best investing options based on your goals, risk tolerance, & investing style. Invest in Canada offers tailored services that make it easier to choose Canada for your next business expansion. Self-directed investing. Easy-to-use tools for buying and selling stocks, ETFs, and more; Resources to build a portfolio, research investments, and discover new. An easy and flexible way to invest · Compare ways to invest. Find an investment option that works for you Investing strategies and insights. Retirement. TD Direct Investing offers investment options that include stocks, ETFs, mutual funds, GICs, fixed income investments, and options trading. ETFs and mutual funds are pooled investments comprising stocks, bonds, and other funds, providing a single diversified investment. The difference between the. A cash bank deposit is the simplest, most easily understandable investment asset—and the safest. It not only gives investors precise knowledge of the interest.

Simple Investment options to build your future with Think of these Portfolios as a simple, low-cost1 way to keep your money working for you – instead of the. Step 4: Your Investment options · Shares · Funds · Exchange Traded Funds (ETFs) · Investment Trusts · Bonds and Gilts. Compare Investment Portfolios · ScholarShare investment choices · Wide range of investments. Simple steps. · Have any questions? ScholarShare is here to. Commission-free online trades apply to trading in U.S.-listed stocks, exchange-traded funds (ETFs) and options. Options trades are subject to a $ Mutual Funds A mutual fund is an easy way to invest in a pool of stocks, bonds and other investments that is managed on your behalf by a professional money. Explore Your Plan Investment Options. We know that choosing investment options can be overwhelming, but The Education Plan® can help make it easy. With a. Option 4: Simple ETF Portfolio The last option is a simple portfolio of three to five exchange traded funds (ETFs). The benefit of ETFs is that you can. Step 4: Your Investment options · Shares · Funds · Exchange Traded Funds (ETFs) · Investment Trusts · Bonds and Gilts. Investment options. There are a variety of investment options Opening a Giving Account is fast and easy, and there is no minimum initial contribution. Commission-free online trades apply to trading in U.S.-listed stocks, exchange-traded funds (ETFs) and options. Options trades are subject to a $ So you can easily use your funds for everyday expenses. Sample debit card. Risk Based Options. From aggressive options seeking higher returns to conservative. This means you might get better returns at the trade-off of no easy access to your cash until the maturity date. Investment options. Stocks, bonds, mutual. If you're looking for a risk-free option with a steady rate of return, consider a GIC or savings account. Easily invest in a pool of stocks, bonds and other. Investment vehicles · Mutual Funds Invest in professionally managed funds that provide easy diversification and strong growth potential. · Segregated Funds. Although choosing investments can be overwhelming, there are simple choices, like all-in-one funds and robo advisors, that can make it easier. Simply put. 2. Diversify, diversify, diversify You can help protect your portfolio against large drops in the market and also potentially boost your portfolio's value. Four investment options for generating retirment income: Income annuity, a diversified bond portfolio, easily as you can trade stocks. Note that prices. Simple and easy-to-use platform · DIY (Wealthsimple Trade) and Robo Advisor (Managed Investing) Options · Fractional shares in the DIY account allow you to buy as. Discover your investment options. Investing can be simple. We'll explain how it works so you can make smart choices. Create your plan, with our help. Our. The UC Retirement Savings Program's investment menu is designed to make it easier for you to build a diversified, lower-cost investment mix that matches.

Working Capital Definition Business

/how-to-calculate-working-capital-on-the-balance-sheet-357300-color-2-d3646c47309b4f7f9a124a7b1490e7de.jpg)

The working capital is the amount of available money you have to run your business within each financial year. If you want to know how to calculate working. Working capital is an indicator of the short-term financial position that measures the overall efficiency of an organization. Working capital measures a business's ability to cover upcoming costs. The surplus or deficit is measured in dollars. Key Highlights · Net working capital is an important concept not just for analyzing a company, but also how it impacts the calculation of a company's cash flows. Some people also define the two concepts as gross concept and net concept. According to quantitative concept, the amount of working capital refers to 'total of. Working capital is a fundamental accounting metric that measures a company's short-term financial health by subtracting current liabilities from current assets. Working capital is the difference between current assets and current liabilities used to fund daily business operations. If defined formally, working capital is the difference between a business's assets and liabilities. The current assets represent the part of business assets. Working capital is the difference between current assets and current liabilities used to fund daily business operations. The working capital is the amount of available money you have to run your business within each financial year. If you want to know how to calculate working. Working capital is an indicator of the short-term financial position that measures the overall efficiency of an organization. Working capital measures a business's ability to cover upcoming costs. The surplus or deficit is measured in dollars. Key Highlights · Net working capital is an important concept not just for analyzing a company, but also how it impacts the calculation of a company's cash flows. Some people also define the two concepts as gross concept and net concept. According to quantitative concept, the amount of working capital refers to 'total of. Working capital is a fundamental accounting metric that measures a company's short-term financial health by subtracting current liabilities from current assets. Working capital is the difference between current assets and current liabilities used to fund daily business operations. If defined formally, working capital is the difference between a business's assets and liabilities. The current assets represent the part of business assets. Working capital is the difference between current assets and current liabilities used to fund daily business operations.

It is the capital that a business uses to meet its daily expenses and is considered to be the most liquid part of the total capital. Working capital is the difference between a company's current assets and current liabilities. It is a financial measure, which calculates whether a company has. The definition of working capital is the difference between your assets and liabilities. The assets that you own in your business are considered an investment. Intuitively, it seems sufficient to calculate net working capital as the difference between current assets and current liabilities. Working capital management is a business process that helps companies make effective use of their current assets and optimize cash flow. Definition of Working Capital. Working capital is the amount of cash and liquid assets a company owns. In the normal course of operations, a business must have. Working capital as defined by the literature is the excess of current assets over current liabilities—that is, cash and other liquid assets expected to be. noun: capital actively turned over in or available for use in the course of business activity: a: the excess of current assets over current liabilities. Working capital is the difference between a business's current assets and current liabilities. This doesn't include fixed assets, which are illiquid and can't. Working capital management is defined as the process through which a company plans for utilizing its current assets and liabilities in the best possible manner. Working capital is the difference between a business's current assets and current liabilities. In accounting, the working capital total is usually derived. It's the amount of money you need in order to support your short-term business operations. It's the difference between current assets (such as cash and. Working capital (WC) is a financial metric which represents operating liquidity available to a business, organisation, or other entity. Working Capital: Definition and Importance. A company's working capital is defined as the difference between a company's current assets (such as cash. The amount of money that a business has available to conduct it'd day to day activities. Working capital is a measure of a company's liquidity. Net working capital shows the liquidity of a company by subtracting its current liabilities from its current assets. These are the line items from the balance. Working capital as defined by the literature is the excess of current assets over current liabilities—that is, cash and other liquid assets expected to be. The working capital is the difference between a company's current assets, such as cash, accounts receivable (unpaid invoices from customers) and inventories. Working capital ratio is a measurement that shows a business's current assets as a proportion of its liabilities. It's a metric that provides an overview of. Net working capital refers to the difference between a business's current assets and liabilities. This metric is used to measure the liquidity of a business.

What Are The Best Ipo Stocks To Buy Now

Top 5 Most Anticipated IPOs in · 1. SpaceX IPO – billion USD · 2. Stripe IPO – 68 billion USD · 3. Databricks IPO – 31 billion USD · 4. Discord IPO – Pre-IPO Companies are private firms who intend to have a listing on the stock market leaderboard. In India that would mean being listed on the NSE or BSE or. As Snap (SNAP), Facebook (FB), Square (SQ) and many other IPO stocks have shown, new issues often struggle before they find their footing and take off. So be. Investors tend to buy shares from pre-IPO companies as they sell their shares to investors at a lower or discounted price. When these companies get listed, the. Buy Now. Enhancements you chose aren't available for this seller. Details. To More of Josh's profiles of great investors can be found online at startupwealth. IPO investors can track upcoming IPOs on the websites for exchanges like Nasdaq and the New York Stock Exchange, and various specialty websites. These include. Last IPOs ; BloomZ · BLMZ · Technology ; OneStream, Inc. OS · Technology ; Primega Group Holdings Limited · PGHL · Basic Materials ; Artiva Biotherapeutics, Inc. Which are the best performing IPO stocks in India right now? · #1 IREDA · #2 INOX GREEN ENERGY · #3 RAINBOW CHILDRENS MEDICARE · #4 UDAYSHIVAKUMAR INFRA · #5. IPO Stock Of The Week Duolingo, along with Fidelis and Procore Technologies, are among the best IPO stocks to watch in today's market. Duolingo language app. Top 5 Most Anticipated IPOs in · 1. SpaceX IPO – billion USD · 2. Stripe IPO – 68 billion USD · 3. Databricks IPO – 31 billion USD · 4. Discord IPO – Pre-IPO Companies are private firms who intend to have a listing on the stock market leaderboard. In India that would mean being listed on the NSE or BSE or. As Snap (SNAP), Facebook (FB), Square (SQ) and many other IPO stocks have shown, new issues often struggle before they find their footing and take off. So be. Investors tend to buy shares from pre-IPO companies as they sell their shares to investors at a lower or discounted price. When these companies get listed, the. Buy Now. Enhancements you chose aren't available for this seller. Details. To More of Josh's profiles of great investors can be found online at startupwealth. IPO investors can track upcoming IPOs on the websites for exchanges like Nasdaq and the New York Stock Exchange, and various specialty websites. These include. Last IPOs ; BloomZ · BLMZ · Technology ; OneStream, Inc. OS · Technology ; Primega Group Holdings Limited · PGHL · Basic Materials ; Artiva Biotherapeutics, Inc. Which are the best performing IPO stocks in India right now? · #1 IREDA · #2 INOX GREEN ENERGY · #3 RAINBOW CHILDRENS MEDICARE · #4 UDAYSHIVAKUMAR INFRA · #5. IPO Stock Of The Week Duolingo, along with Fidelis and Procore Technologies, are among the best IPO stocks to watch in today's market. Duolingo language app.

Initial public offerings allow companies to raise capital for their businesses. · Saudi Aramco tops the list of global IPOs, raising $ billion in December. Top 10 IPO in India (By Performance) ; Exicom Tele-Systems Limited, Mar 05, , ; Premier Energies Limited, Sep 03, , ; Platinum Industries. Company Name. Open Date and Close Date. Issue Price ; Archit Nuwood Industries Limited IPO. Rs to ; Western Carriers (India) Limited IPO ; Envirotech. EMEIA regained the No. 1 global IPO market share by number for the first time in 16 years. Industrials led the way in number of IPOs with technology raising the. Find information on upcoming and recent Initial Public Offerings (IPOs) on the Nasdaq. Review company details, offering prices, and performance insights. stocks it trades. Paired with industry-leading technology and the human oversight of the trading floor, stocks trade better on the NYSE. Your listing also. Penny stock screener. Find the best penny stock companies with strong buy analyst ratings to buy today. Buy for a penny for the chance to leverage big. TOP PERFORMING IPOs ; Sathlokhar Synergys E&C Global Ltd, , ; Afcom Holdings Ltd, , ; Effwa Infra & Research Ltd, , ; S A Tech. IPO Calendar ; Sep 12, , Trident Digital Tech Holdings Ltd (TDTH), NASDAQ, M · There were IPOs on the US stock market in This was % lower than the IPOs in , which was an all-time record. There are no upcoming IPOs currently available for this week. Next Week • 2 Total. Company Name, Proposed Symbol, Exchange, Price. Retired: What Now? Complete Retirement Guide · Best & Worst States to (Note to retail investors: Beware before swooping in to buy a hyped IPO stock.). But IPOs can be a misguided topic for many. As a prospective shareholder, keeping an eye on the IPO calendar and buying stock when a company goes public. Stocks in Translation · NEXT · Lead This Way · Good Buy or Goodbye? ETF Report · Financial Freestyle · Capitol Gains · Living Not So Fabulously · Decoding. SME IPO - My Mudra Fincorp Limited · 1,32, · x · ₹33 Crores · ₹ - ₹ ; Shree Tirupati Balajee Agro Trading Company Limited · ₹ · x · ₹Crores. Best Vanguard Mutual Funds to Buy · Home · investing · stocks · IPOs. The 25 Biggest The stock is now down more than 80% from its IPO price. Sponsored. Now, let's get to the main question at hand. Should You Buy IPO Stock? There's no rule of investing that says IPOs are either good or bad. It's important to. Now · R.A. Williams Distributors Limited – IPO Basis of Allotment. Trading Best Practices · Investor Forum · National Investors Education Week (N.I.E.W.). Participating in a new IPO through Schwab allows you to potentially purchase stock at the IPO price. The IPO price is determined by the investment banks hired. Besides the eligibility, you must also research the company you wish to invest in. While previous year has so far been a great year for IPOs, some companies.

Loans For People With Poor Credit History

Secured loans are a popular type of personal loan for those with bad credit. Secured loans require collateral. The most common types are auto loans, home equity. Learn More About Income Based Loans It's fairly common for individuals to have a high income but a bad or poor credit score. There can be a lot of different. Personal loans are accessible to those with bad credit; traditional lenders use credit scores to determine loan decisions and rates. The FHA loan program can help you buy or refinance a house even if you have a bad credit score. FHA home loans are backed by the Federal Housing Administration. Get up to $50, for debt consolidation, home improvement, or any other major expense. See your personalized initial offer with no impact to your credit score. Borrow Through a Credit Union Credit unions are nonprofit, member-owned financial institutions, and they can be more willing to lend to applicants with poor. If you have a low credit score, expect higher interest rates than those with excellent credit scores. Application processing times will also take longer if you. Work with a cosigner who has good credit. When you have a cosigner for a loan, the lender considers their credit history in the application, improving your. If your credit is extremely poor, consider secured loan options. Secured loans require collateral, such as a car, home, or savings account. Offering collateral. Secured loans are a popular type of personal loan for those with bad credit. Secured loans require collateral. The most common types are auto loans, home equity. Learn More About Income Based Loans It's fairly common for individuals to have a high income but a bad or poor credit score. There can be a lot of different. Personal loans are accessible to those with bad credit; traditional lenders use credit scores to determine loan decisions and rates. The FHA loan program can help you buy or refinance a house even if you have a bad credit score. FHA home loans are backed by the Federal Housing Administration. Get up to $50, for debt consolidation, home improvement, or any other major expense. See your personalized initial offer with no impact to your credit score. Borrow Through a Credit Union Credit unions are nonprofit, member-owned financial institutions, and they can be more willing to lend to applicants with poor. If you have a low credit score, expect higher interest rates than those with excellent credit scores. Application processing times will also take longer if you. Work with a cosigner who has good credit. When you have a cosigner for a loan, the lender considers their credit history in the application, improving your. If your credit is extremely poor, consider secured loan options. Secured loans require collateral, such as a car, home, or savings account. Offering collateral.

Get a loan quickly even with no credit history. Fixed, affordable payments available. Prequal won't affect your credit score. Apply now. Most lenders (even those that work with bad credit borrowers) require credit scores above , but adding a creditworthy cosigner or co-borrower to your loan. Loan alternative to payday loans that doesn't require credit check. Easily apply without affecting your FICO® credit score and get a loan up to $! Upgrade's minimum credit score requirement is only This lender offers unsecured and secured personal loans with flexible repayment terms ranging from 24 to. Get the funds you need fast by exploring the best bad credit loans from top lenders like Discover, Upstart, & SoFi. Find your lowest rate & apply online! Having a secured card and making timely payments on it can help you rebuild a bad credit score and eventually qualify for a regular card. It also is a good way. As long as the student qualifies for these loans under the FAFSA, they can borrow even with bad credit. Federal Direct PLUS loans require credit a check. Overall, Upgrade has a strong reputation for being a fair lender with a lower minimum credit score, a high borrowing limit, and longer loan terms than some. People with no credit are often discouraged by the idea of applying for a loan with a traditional bank or credit union. Bad credit personal loans often come in. Personal loans for credit scores are typically not advised. However, some lenders may be willing to offer personal loans for credit scores at or below. A bad credit loan is a loan given to people with a credit score below Bad credit loans are available to individuals who haven't yet built a credit history. There are still several options for those who have a bad repayment history, like guarantor loans. A guarantor loan is another popular type of option for those. In contrast to unsecured loans, secured loans involve an asset that the borrower offers as collateral. They allow those with poor credit to borrow by allowing. Loans for bad credit are designed for people who've struggled to get a loan previously or who haven't yet built up a credit score. Borrowing a small amount and. Bad credit personal loan options work similarly to any other loan, except that they are designed for borrowers with no credit score or a low credit score. Those. If you have bad credit, you may be able to cash in on the equity you've built into your home using a home equity loan. These loans have fixed rates and are. Whether you have good credit, bad credit or something in between, FCU has personal loans designed for you¹. No collateral is required, applying is easy. If you have a bad credit history and a low credit score it can be difficult to be accepted for a personal loan. There are specialist bad credit lenders. But if. A low credit score should not limit you from getting a loan. Find the best loans for bad credit at the best rates for you. Yes, lenders do hard credit checks whenever you apply for loans, including bad credit loans. Looking for a loan with no credit check is not advisable. All.

What Do You Do When You Buy Stock

The best time to buy a stock is when an investor has done their research and due diligence, and decided that the investment fits their overall strategy. With. A first step is thinking through your investment goals, time horizon, and ability to handle risk. This is key, as any investment involves some risk of losing. Stocks are a type of security that gives stockholders a share of ownership in a company. Companies sell shares typically to gain additional money to grow the. The most common way to buy and sell shares is by using an online broking service or a full service broker. When shares are first put on the market, you can. 1. Research the company: Find out what they do · 2. Look at the company's price-to-earnings ratio · 3. Estimate a company's risk by its beta · 4. Examine the. Stock can be purchased using the funds in your Cash App balance. If you do not have enough funds available, the remaining amount will be debited from your. Depending on the type of share, you can vote in shareholder decisions, and you may also receive dividends, literally profit sharing. Upvote. Stocks are available for companies in a wide variety of industries, so you can tap into your knowledge of specific businesses. They can also help you diversify. You now own the company. When the election for Board of Directors happens, you get all of the votes, and you can elect a board that will select. The best time to buy a stock is when an investor has done their research and due diligence, and decided that the investment fits their overall strategy. With. A first step is thinking through your investment goals, time horizon, and ability to handle risk. This is key, as any investment involves some risk of losing. Stocks are a type of security that gives stockholders a share of ownership in a company. Companies sell shares typically to gain additional money to grow the. The most common way to buy and sell shares is by using an online broking service or a full service broker. When shares are first put on the market, you can. 1. Research the company: Find out what they do · 2. Look at the company's price-to-earnings ratio · 3. Estimate a company's risk by its beta · 4. Examine the. Stock can be purchased using the funds in your Cash App balance. If you do not have enough funds available, the remaining amount will be debited from your. Depending on the type of share, you can vote in shareholder decisions, and you may also receive dividends, literally profit sharing. Upvote. Stocks are available for companies in a wide variety of industries, so you can tap into your knowledge of specific businesses. They can also help you diversify. You now own the company. When the election for Board of Directors happens, you get all of the votes, and you can elect a board that will select.

During regular market hours ( AM-4 PM ET), dollar-based buy orders are entered as market orders, and share-based buy orders are entered as limit orders with. Investors can either buy stock (long stock) if they are bullish, or sell stock (short stock) if they are bearish. Discover how to buy and sell stocks and. Higher growth potential — Equities serve as a cornerstone for many portfolios because of their potential for growth. In the following chart, you can see that. Investors can cash out stocks by selling them on a stock exchange through a broker. Stocks are relatively liquid assets, meaning they can be converted into. Before you can start purchasing stocks, you need to select a brokerage account to do it through. You can choose to go with a trading platform offered by a. When you buy a share in a company, you become an owner of that company. And as an owner, you'll share in the ups and downs of the business which lead to the. The most common way to buy and sell shares is by using an online broking service or a full service broker. When shares are first put on the market, you can. Cash App Stocks makes buying stocks easy, whether you're new to the stock market or already have a portfolio. Invest as much or as little as you want. Investors buy and sell stocks for a number of reasons including the potential to grow the value of their investment over time, to potentially profit from. One of the ways to buy shares online is through a market order. Market orders simply tell your broker that you are willing to take whatever price is presented. You can buy and sell stocks through: Direct stock plans. Some companies allow you to buy or sell their stock directly through them without using a broker. The best time to buy a stock is when an investor has done their research and due diligence, and decided that the investment fits their overall strategy. With. Higher growth potential — Equities serve as a cornerstone for many portfolios because of their potential for growth. In the following chart, you can see that. Firstly, log in to your brokerage account and navigate to the trading platform. Choose the stock you want to buy or sell and select the order type—common types. Nothing in the Stock Market Is Guaranteed · Know You're Betting on Yourself · Know Your Goals, Timeframe and Risk Tolerance · Research, Research, Research · Keep. You can easily fund your brokerage account via an electronic funds transfer, by mailing a check, or by wiring money. Or, if you have an existing brokerage. The first step is for you to open a brokerage account. You need this account to access investments in the stock market. You can open a brokerage account for. Trading stocks offers risks and rewards for traders. Whether you should trade stocks is a personal decision based on your risk tolerance, financial goals and. Within the Ally app, you'll select Trade (or QuickTrade on desktop). There, you can enter the stock symbol (aka ticker) and quantity of shares before. The more stocks you purchase, the more safe you will be in case one stock drops significantly. Experts often recommend 30 to different stocks but that is.

1 2 3 4 5 6 7