tusfrases.ru

Prices

How Much To Afford A House

Most financial advisors recommend spending no more than 25% to 28% of your monthly income on housing costs. Add up your total household income and multiply it. Use our new house calculator to determine how much of a mortgage you may be able to obtain. Income and Debt Obligations. Discover how much house you can afford based on your income, and calculate your monthly payments to determine your price range and home loan options. You may have heard the term “house poor.” This term is used when more than 28% of your income is allocated toward your housing, which includes principal. To calculate "how much house can I afford," one rule of thumb is the 28/36 rule, which states that you shouldn't spend more than 28% of your gross monthly. Determining how much house you can afford is about a lot more than just the purchase price of the home and how much money you have to bring to the closing. Our home affordability tool calculates how much house you can afford based on several key inputs: your income, savings and monthly debt obligations. A good rule of thumb is that the maximum cost of your house should be no more than to 3 times your total annual income. This means that if. How Much Can You Afford? · You can afford a home worth up to $, with a total monthly payment of $1, · Related Resources. Most financial advisors recommend spending no more than 25% to 28% of your monthly income on housing costs. Add up your total household income and multiply it. Use our new house calculator to determine how much of a mortgage you may be able to obtain. Income and Debt Obligations. Discover how much house you can afford based on your income, and calculate your monthly payments to determine your price range and home loan options. You may have heard the term “house poor.” This term is used when more than 28% of your income is allocated toward your housing, which includes principal. To calculate "how much house can I afford," one rule of thumb is the 28/36 rule, which states that you shouldn't spend more than 28% of your gross monthly. Determining how much house you can afford is about a lot more than just the purchase price of the home and how much money you have to bring to the closing. Our home affordability tool calculates how much house you can afford based on several key inputs: your income, savings and monthly debt obligations. A good rule of thumb is that the maximum cost of your house should be no more than to 3 times your total annual income. This means that if. How Much Can You Afford? · You can afford a home worth up to $, with a total monthly payment of $1, · Related Resources.

This home affordability calculator looks at your entire financial situation to help you determine how much you can realistically spend on the home of your. To determine how much you can afford for your monthly mortgage payment, just multiply your annual salary by and divide the total by This will give you. The fastest way of estimating how much house you can afford on your salary is to multiply your annual income by 3 and 4. How much you can afford to spend on a home depends on several factors, including these primary factors: you and your co-borrower's annual income, down payment. A “starter home” may be in the K - K range, lower or higher depending on where you live and the cost of living there. People may have. Our affordability calculator estimates how much house you can afford by examining factors that impact affordability like income and monthly debts. How much house can I afford? ; $, Home Price ; $1, Monthly Payment ; 28%. Debt to Income. This rule asserts that you do not want to spend more than 28% of your monthly income on housing-related expenses and not spend more than 36% of your income. A DTI ratio is your monthly expenses compared to your monthly gross income. Lenders consider monthly housing expenses as a percentage of income and total. To get a rough estimate of what you can afford, most lenders suggest you spend no more than 28% of your monthly income — before taxes are taken out — on your. Free house affordability calculator to estimate an affordable house price based on factors such as income, debt, down payment, or simply budget. So start by doing the math. If you make $50, a year, your total yearly housing costs should ideally be no more than $14,, or $1, a month. If you make. Use this home affordability calculator to get an estimate of the home price you can afford based upon your income, debt profile and down payment. Use this tool to calculate the maximum monthly mortgage payment you'd qualify for and how much home you could afford. Use PrimeLending’s home affordability calculator to determine how much house you can afford. Enter your income, monthly debt, and down payment to find a. One way to start is to get pre-approved by a lender, who will look at factors such as your income, debt and credit, as well as how much you have saved for a. From the Internet. "28% rule. To determine how much you can afford using this rule, multiply your monthly gross income by 28%. For example, if. The annual salary needed to afford a $, home is about $, Photo illustration by Fortune; Original photo by Getty Images. Over the past few years. Your total housing payment (including taxes and insurance) should be no more than 32 percent of your gross (pre-taxes) monthly income. The sum of your total. Find out how much you can realistically afford to pay for your next house. You can estimate the mortgage amount that works with your budget by entering details.

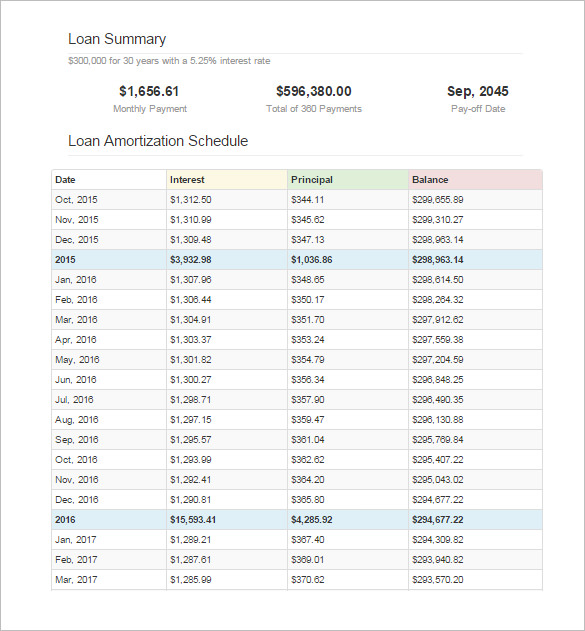

Online Mortgage Calculator Amortization Schedule

This amortization schedule calculator allows you to create a payment table for a loan with equal loan payments for the life of a loan. Examine your principal balances, determine your monthly payment, or figure out your ideal loan amount with our amortization schedule calculator. An online mortgage calculator can help you quickly and accurately predict your monthly mortgage payment with just a few pieces of information. Online banking. Card number. Card number. Remember my card. Delete this This table shows how your mortgage debt decreases over your amortization period. Determine what you could pay each month by using this mortgage calculator to calculate estimated monthly payments and rate options for a variety of loan. Use this calculator to generate an estimated amortization schedule for your current mortgage. Quickly see how much interest you could pay and your estimated. An amortization schedule is a table showing regularly scheduled payments and how they chip away at the loan balance over time. Bret's mortgage/loan amortization schedule calculator: calculate loan payment, payoff time, balloon, interest rate, even negative amortizations. Use this Amortization Schedule Calculator to estimate your monthly loan or mortgage repayments, and check a free amortization chart. This amortization schedule calculator allows you to create a payment table for a loan with equal loan payments for the life of a loan. Examine your principal balances, determine your monthly payment, or figure out your ideal loan amount with our amortization schedule calculator. An online mortgage calculator can help you quickly and accurately predict your monthly mortgage payment with just a few pieces of information. Online banking. Card number. Card number. Remember my card. Delete this This table shows how your mortgage debt decreases over your amortization period. Determine what you could pay each month by using this mortgage calculator to calculate estimated monthly payments and rate options for a variety of loan. Use this calculator to generate an estimated amortization schedule for your current mortgage. Quickly see how much interest you could pay and your estimated. An amortization schedule is a table showing regularly scheduled payments and how they chip away at the loan balance over time. Bret's mortgage/loan amortization schedule calculator: calculate loan payment, payoff time, balloon, interest rate, even negative amortizations. Use this Amortization Schedule Calculator to estimate your monthly loan or mortgage repayments, and check a free amortization chart.

An amortization schedule for a loan is a list of estimated monthly payments. At the top, you'll see the total of all payments. For each payment, you'll see the. Use this amortization calculator to estimate the principal and interest payments over the life of your mortgage. You can view a schedule of yearly or monthly. Amortization schedules can be customized based on your loan and your personal circumstances. With more sophisticated amortization calculators you can compare. Create a printable amortization schedule, with dates and subtotals, to see how much principal and interest you'll pay over time. This calculator will calculate. This calculator will figure a loan's payment amount at various payment intervals - based on the principal amount borrowed, the length of the loan and the annual. This calculator will compute a loan's payment amount at various payment intervals -- based on the principal amount borrowed, the length of the loan and the. The amortization schedule illustrates a blended loan. Blended payments do not apply for loans processed online or variable-rate loans. Please contact us to. This amortization calculator shows the schedule of paying extra principal on your mortgage over time. See how extra payments break down over your loan term. Flexible Mortgage Payment Features Calculator At some point, you may need to pay less than usual on your mortgage or take a break entirely. Use this. Free mortgage calculator to find monthly payment, total home ownership cost, and amortization schedule with options for taxes, PMI, HOA, and early payoff. The Mortgage Amortization Calculator provides an annual or monthly amortization schedule of a mortgage loan. It also calculates the monthly payment amount. Our free and easy to use basic amortization calculator shows you what your monthly payments will be, and breaks down the capital and interest paid over. An amortization schedule is a table that shows homeowners how much money they will pay in principal (starting amount of the loan) and in interest over time. It. Check out the web's best free mortgage calculator to save money on your home loan today. Estimate your monthly payments with PMI, taxes. Loan Calculator with Amortization Schedule. Print-Friendly, Mobile-Friendly. Calculate Mortgages, Car Loans, Small Business Loans, etc. The amortization schedule shows what you are paying in interest and principal for each and every payment. While amortization schedules are not necessarily. Mortgage Payment Calculator. Calculate your mortgage payments based on how much you borrow, your interest rate, mortgage term and payment schedule. · How Much. This calculator will compute a loan's payment amount at various payment intervals -- based on the principal amount borrowed, the length of the loan and the. An amortization calculator helps you understand how fixed mortgage payments work. It shows how much of each payment reduces your loan balance and how much. Amortization Schedule ; Mar , $, $ ; Apr , $, $ ; May , $, $ ; Jun , $, $

High Interest Savings Account Percentage

Grow your savings with our high-interest savings account. Earn % APY 1 guaranteed for the first 5 months. Use our High Interest Savings account to earn up to % APY on balances up to $2, No matter which free savings account you choose, you'll enjoy the. $11, with % APY. INTEREST EARNED. $1, INITIAL DEPOSIT. 19, , was %. At the same time, there were a number of high-yield savings accounts offering APYs of 5% and higher. The best CD accounts also offer a. High interest savings account. · Get % APY1 on all your cash · Boost your earnings with Automatic Savings features · No monthly fees. Take advantage of our rewards checking account that pays % cash back on purchases AND earns interest at % APY, as of August 30, stopwatch icon. Currently, the top high-yield savings accounts pay up to % APY. These rates fluctuate and will likely change with the current economic environment. That. Earn more interest with a high yield savings account. Quickly build your savings with rates 15x the bank industry average! A high yield savings account to help reach financial goals with a % Annual Percentage Yield & no minimum balance or service fees. Apply online today! Grow your savings with our high-interest savings account. Earn % APY 1 guaranteed for the first 5 months. Use our High Interest Savings account to earn up to % APY on balances up to $2, No matter which free savings account you choose, you'll enjoy the. $11, with % APY. INTEREST EARNED. $1, INITIAL DEPOSIT. 19, , was %. At the same time, there were a number of high-yield savings accounts offering APYs of 5% and higher. The best CD accounts also offer a. High interest savings account. · Get % APY1 on all your cash · Boost your earnings with Automatic Savings features · No monthly fees. Take advantage of our rewards checking account that pays % cash back on purchases AND earns interest at % APY, as of August 30, stopwatch icon. Currently, the top high-yield savings accounts pay up to % APY. These rates fluctuate and will likely change with the current economic environment. That. Earn more interest with a high yield savings account. Quickly build your savings with rates 15x the bank industry average! A high yield savings account to help reach financial goals with a % Annual Percentage Yield & no minimum balance or service fees. Apply online today!

The national average savings account yield was percent APY, according to Bankrate's survey of institutions as of Aug. How Bankrate calculates the. Huntington Relationship Savings is our higher interest-bearing savings account. Earn competitive interest on all balances above $ and skip the monthly. High-Growth Money Market ; Tier, Annual Percentage Yield (APY) ; $–$9,, % ; $10,–$24,, % ; $25,–$99,, % ; $,–$,, %. As mentioned above, the main benefit of an HYSA is they offer higher rates. According to the Federal Deposit Insurance Corporation (FDIC), the average interest. Review Bank of America's interest rates and annual percentage yields (APYs) for checking, savings, CD and IRA accounts specific to your area. Unlike a traditional savings account, the EverBank Performance Savings account acts as a high-yield savings account. With an APY of %1, our account is. Summary of the Best 5% Interest Savings Accounts of ; M1 High-Yield Savings Account, Earn up to % APY when you deposit at least $25, into a new Elite Money Market Account or an existing account that was opened within the last 30 days. Estimated interest earned $16, dollars Based on selected time period and % APY. Interest is compounded and credited to your account on a monthly. A high-yield savings account (HYSA) is a savings account that pays a higher interest rate than traditional savings accounts. Tap the button to select banks ; % APY $ ; National Average % APY $92 ; Ally Bank % APY $ ; American Express % APY $ ; Chase % APY $4. Balance. Relationship Interest Rate. Relationship APY ; $0 or more. %. %. % APY Annual Percentage Yield. Our High-Yield Online Savings Account is the smart choice for anyone looking to grow their savings and achieve financial. Just maintain a balance of $10, or more to earn interest. It's easy to open an account: Current Members - Open in Online Banking | New to Citadel? Open An. High-yield savings accounts are a great place to help you earn interest on your savings. Currently, the top high-yield savings accounts pay up to % APY. Best High-Yield Savings Accounts for August ; Capital One Performance Savings · APY: %; No minimum opening balance or monthly maintenance fee ; Ally. Earn up to % APY. No maintenance or service fees. No minimum deposit requirement. Complimentary ATM card. Digital tools for seamless remote banking. The minimum balance to open the account is $ If your daily balance is $50, or more, the APY is %. If your daily balance is between $10, and. Interest Rate% ; Annual Percentage Yield (APY)% ; Minimum Balance to Open$50, ; Minimum to Earn APY.

Best Credit Card With 0 On Purchases

Explore low intro rate credit cards ; NEW CARD MEMBER OFFER ; Earn a one-time $ cash bonus once you spend $ on purchases within 3 months from account. No Annual Fee Credit Cards · Synchrony Premier World Mastercard® · Capital One Quicksilver Cash Rewards Credit Card · Capital One SavorOne Cash Rewards Credit Card. Wells Fargo Reflect® Card: Best for Longest 0% intro period · BankAmericard® credit card: Best for Long intro period + straightforward benefits · U.S. Bank Visa®. Amex EveryDay Credit Card · Created with Sketch. 2X points at U.S. supermarkets, on up to $6K per year in purchases (then 1%). · 1X points on other purchases. A credit card balance transfer with a 0% annual percentage rate (APR) seems like a great deal: Pay 0% APR on transferred balances for up to 21 months. The Wells Fargo Reflect® Card stands out with its month 0% intro APR for both balance transfers and purchases, which is among the longest on the market. With. Wells Fargo Reflect® Card: Best for a long intro period Here's why: This card offers a 0% introductory APR for 21 months on purchases and balance transfers. Best card for 0% APR on purchases for first year · e.g. Amex BCP $8, limit, May · e.g. Chase Freedom Flex $10, limit, June Discover the best zero interest credit cards of September with 0% APR offers on purchases and balance transfers. Compare top cards to find the perfect fit. Explore low intro rate credit cards ; NEW CARD MEMBER OFFER ; Earn a one-time $ cash bonus once you spend $ on purchases within 3 months from account. No Annual Fee Credit Cards · Synchrony Premier World Mastercard® · Capital One Quicksilver Cash Rewards Credit Card · Capital One SavorOne Cash Rewards Credit Card. Wells Fargo Reflect® Card: Best for Longest 0% intro period · BankAmericard® credit card: Best for Long intro period + straightforward benefits · U.S. Bank Visa®. Amex EveryDay Credit Card · Created with Sketch. 2X points at U.S. supermarkets, on up to $6K per year in purchases (then 1%). · 1X points on other purchases. A credit card balance transfer with a 0% annual percentage rate (APR) seems like a great deal: Pay 0% APR on transferred balances for up to 21 months. The Wells Fargo Reflect® Card stands out with its month 0% intro APR for both balance transfers and purchases, which is among the longest on the market. With. Wells Fargo Reflect® Card: Best for a long intro period Here's why: This card offers a 0% introductory APR for 21 months on purchases and balance transfers. Best card for 0% APR on purchases for first year · e.g. Amex BCP $8, limit, May · e.g. Chase Freedom Flex $10, limit, June Discover the best zero interest credit cards of September with 0% APR offers on purchases and balance transfers. Compare top cards to find the perfect fit.

Citi Custom Cash® Card · 5% |or 1%Cash Back · Low intro APRon purchases & balance transfers · No annual fee. Best 0% Intro APR on Purchases Credit Card Offers · Discover it® Miles · Citi Rewards+ Card · Wells Fargo Reflect Card · Capital One VentureOne Rewards Credit Card. JetBlue. Plus Card. Earn 50, bonus points. after qualifying account activity ; Banana Republic Rewards. Mastercard · Receive 20% off your first purchase. with. Visa Credit Cards ; Wells Fargo Active Cash® Card. Visa Signature®. Visa Infinite®. Wells Fargo Active Cash® Card. INTRO PURCHASE APR. 0% intro APR for 12 months. The Wells Fargo Reflect® Card is the best intro 0% APR credit card overall. You can get a zero-interest promotion for 21 months from account opening on. humm 90 Platinum Mastercard - up to days · People's Choice Visa Credit Card - up to 62 days · Beyond Bank Low Rate Visa Credit Card - up to 62 · Bank of us. 0% Intro APR † for 18 billing cycles for purchases, and for any balance transfers made in the first. Learn more about 0% Intro APR Credit Cards from Chase that can help you save money on interest from purchases and find the best option for your financial. For a limited time, get our best rate ever: 0% intro APR* on purchases and balance transfers† for 21 billing cycles. After that, the APR is variable, currently. 4 Best Zero-Interest Credit Cards in · Citi Diamond Preferred Card - Best for balance transfers · Capital One VentureOne Rewards Credit Card - Best for. Citi® Diamond Preferred® Card 0% Intro APR for 21 months on balance transfers from date of first transfer and 0% Intro APR for 12 months on purchases from date. 14 partner offers ; Discover it Cash Back · 0% Intro APR on Purchases and Balance Transfers for 15 months ; Blue Cash Preferred Card from American Express · 0% on. Explore 0% intro APR credit cards from Wells Fargo to enjoy an interest grace period on eligible purchases. Find the best 0% intro APR card for you and. Save more of your hard-earned money and apply for a Bank of America® credit card with a low intro APR on purchases. Another card from the line of Chase Ink Business cards, this one offers 0% Intro APR on Purchases for 12 months. Otherwise the purchase rate is % - %. The Chase Freedom Unlimited's long 0% APR period, generous sign-up bonus and ongoing rewards could net you thousands in interest savings and cash back. Consumer Credit Card · 6-month everyday financing** on purchases of $ or more. · 1 year to make returns. See The Home Depot Returns Policy for details. · Zero. With a 0% intro APR on balance transfers for the first 18 billing cycles, thereafter a variable APR of % - %, and no annual fee, the value of our. Capital One VentureOne Rewards Credit Card: Best for travel · Chase Freedom Unlimited®: Best for transferable points · Blue Cash Preferred® Card from American. Put simply, a 0% purchase card offers a number of months where no interest is charged on new purchases. This can save you £1,s compared with the same.

True Companion Pet Insurance Reviews

Trupanion covers up to 90% of eligible expenses, has unlimited payouts-always, and can pay your vet bill, within seconds, at time of checkout. ASPCA Pet Health Insurance plans covers exam fees, which are part of nearly every veterinary bill. Trupanion does not cover these charges. Trupanion Reviews. 7, The Trupanion team has been taking care of pet owners for over a decade by offering simple, fair, and affordable pet insurance. I insured my year-old cat with Pet's Best. If he had been younger, I might have gone with someone else, but I don't have real complaints. The Trupanion team has been taking care of pet owners for over a decade by offering simple, fair, and affordable pet insurance. We want to help take care of. While Pumpkin and Trupanion both offer pet insurance plans that cover accidents & illnesses, there are some key coverage differences you should be aware of. Trupanion has proven to be unprofessional, inefficient, and more concerned with finding reasons to deny claims than actually supporting the health and well-. Best Dog Insurance: Trupanion Pet Insurance or Pet Secure? Willowcreek Border Collies offers two options for pet insurance. Compare and decide which is. Trupanion. (1, reviews). Pet Insurance. Open • Open 24 hours. Add Review true colors. Despite a detailed appeal from the veterinary surgeon. Trupanion covers up to 90% of eligible expenses, has unlimited payouts-always, and can pay your vet bill, within seconds, at time of checkout. ASPCA Pet Health Insurance plans covers exam fees, which are part of nearly every veterinary bill. Trupanion does not cover these charges. Trupanion Reviews. 7, The Trupanion team has been taking care of pet owners for over a decade by offering simple, fair, and affordable pet insurance. I insured my year-old cat with Pet's Best. If he had been younger, I might have gone with someone else, but I don't have real complaints. The Trupanion team has been taking care of pet owners for over a decade by offering simple, fair, and affordable pet insurance. We want to help take care of. While Pumpkin and Trupanion both offer pet insurance plans that cover accidents & illnesses, there are some key coverage differences you should be aware of. Trupanion has proven to be unprofessional, inefficient, and more concerned with finding reasons to deny claims than actually supporting the health and well-. Best Dog Insurance: Trupanion Pet Insurance or Pet Secure? Willowcreek Border Collies offers two options for pet insurance. Compare and decide which is. Trupanion. (1, reviews). Pet Insurance. Open • Open 24 hours. Add Review true colors. Despite a detailed appeal from the veterinary surgeon.

I had a cat with chronic kidney disease, who ended up with a lengthy emergency care hospital stay. Trupanion saved me several thousand dollars on this and. When comparing coverage, Trupanion and Pets Best Pet Insurance both have an unlimited benefit plan, and coverage for prescription medications. Both Trupanion. Fetch Pet Insurance is proud to protect over , pets (and counting!) with the most comprehensive coverage. Trupanion has limited or no coverage when it. companion. It has become increasingly popular. Having Read pet insurance consumer reviews to find out what others are saying about insurance companies. My experience serves as a warning to others: Trupanion is not a trustworthy company and will likely leave you high and dry when you need them most. Save your. Trupanion is a leading provider of medical insurance for cats and dogs. We are helping pet owners afford unexpected veterinary costs while also helping the. Trupanion is the fastest-growing player in the pet medical insurance space. We are known for superior coverage and top-notch customer service. Our vet in the US recommended Trupanion as the best on the market and we absolutely agree. Our cat is asthmatic and this is covered under our insurance. There. 1. Trupanion plans don't cover exam fees for covered conditions. Spot plans do. Trupanion plans don't cover exam fees for covered conditions. With pet insurance. M posts. Discover videos related to Trupanion Pet Insurance Reviews on TikTok. See more videos about Chameleon Pet, Pet Supplies, Mango Pet Original. I am % satisfied with Trupanion. They are the true lover of our friends, dogs and cats! Show details. With Trupanion, you're free to go to any licensed veterinarian in the United States, Canada, or Puerto Rico. Are routine veterinary visits covered? While Healthy Paws returned a quote of $ per month, Trupanion was over 50% more expensive at $ per month. To get an idea of the price range you can. Petplan has an excellent reputation, and I've used The Co-operative for my pet insurance (whom I believe use Petplan/base policies on Petplan. Embrace promotes, rewards, and encourages healthy pets by offering Wellness Rewards, an optional non-insurance product that reimburses for everyday veterinary. But monthly premiums costs will likely be higher in exchange for this comprehensive coverage. For this reason, Trupanion might not be the best choice for pet. Recommended Reviews - True Companion Pet Care. Your trust is our top concern, so businesses can't pay to alter or remove their reviews. Learn more about reviews. At Harmony Animal Hospital, we strongly recommend considering pet insurance coverage for your furbabies' accident and illness-related medical expenses. We've. Trupanion medical insurance is your pet's BFF according to veterinarians surveyed across the country. Watch a short video and see how Trupanion pet insurance. American Pet Insurance Company has an AM Best Financial Strength Rating of NR as of 1/30/ ZPIC Insurance Company has an AM Best Financial Strength Rating.

Interest On Savings

It's not easy to find savings accounts that pay interest rates up to 5%, but they do exist. Here's how to find the best savings accounts that pay up to 5%. ***Citi Miles Ahead Savings, certain Savings accounts that are Tiered interest rate discount or closing cost discount based on Citi Eligible Balances. Chase Savings℠ account earns interest, see current rates. Learn how interest rate on savings accounts is compounded & credited monthly. Savings Builder · Get % interest rate from the day the account is opened through the first Evaluation Day · Continue earning up to % APY by: · Deposit. Your money works harder with interest on your savings. Icon of deposit slip and smartphone. Convenient ways to make a. The % APY is guaranteed for the first 5 months after account opening. After the promotional period, the account will earn the posted interest rate of the. Our savings account calculator will help you see how much interest your savings account is earning—or if it's time to change banks to earn more. Open a Bask Interest Savings Account online in 15 minutes or less. Start earning % APY with no monthly account fees. A high yield savings account to help reach financial goals with a % Annual Percentage Yield & no minimum balance or service fees. Apply online today! It's not easy to find savings accounts that pay interest rates up to 5%, but they do exist. Here's how to find the best savings accounts that pay up to 5%. ***Citi Miles Ahead Savings, certain Savings accounts that are Tiered interest rate discount or closing cost discount based on Citi Eligible Balances. Chase Savings℠ account earns interest, see current rates. Learn how interest rate on savings accounts is compounded & credited monthly. Savings Builder · Get % interest rate from the day the account is opened through the first Evaluation Day · Continue earning up to % APY by: · Deposit. Your money works harder with interest on your savings. Icon of deposit slip and smartphone. Convenient ways to make a. The % APY is guaranteed for the first 5 months after account opening. After the promotional period, the account will earn the posted interest rate of the. Our savings account calculator will help you see how much interest your savings account is earning—or if it's time to change banks to earn more. Open a Bask Interest Savings Account online in 15 minutes or less. Start earning % APY with no monthly account fees. A high yield savings account to help reach financial goals with a % Annual Percentage Yield & no minimum balance or service fees. Apply online today!

Grow your personal savings with a high-yield savings rate—NaN APY. Open How to Calculate Interest Earned on a Savings Account. Article | January High-Interest Savings Accounts from Discover Bank, Member FDIC offer high yield interest rates with no monthly balance requirements or monthly fees. What are today's savings interest rates? The national average savings account interest rate is % as of August 23, , according to the latest numbers. The national average annual percentage yield for savings accounts is %. Top Savings Account Interest Rates. SoFi Checking and Savings logo. SoFi. Use SmartAsset's free savings calculator to determine how your future savings will grow based on APY, initial deposit and periodic contributions. High-Rate Savings Account Features · Bank anytime, anywhere with Alliant Mobile and Online Banking · Earn our best rate on all of your money with only a $ Use our High Interest Savings account to earn up to % APY on balances up to $2, No matter which free savings account you choose, you'll enjoy the. High yield savings accounts are a flexible and easy way to earn interest while saving money. Learn More. How. Compound interest on a savings account is calculated on principal and earned interest from previous periods. Essentially your earnings are reinvested and future. Essentially, a high-yield savings account is a savings account with a higher interest rate than traditional savings accounts. In savings accounts, interest. In savings accounts, interest can be compounded, either daily, monthly, or quarterly. The more frequently interest is added to your balance, the faster your. You do not pay tax on your savings interest if you're on a low income. A savings account is a type of bank account that allows you to safely save money while earning interest. Savings can come in the form of a traditional savings. It's not easy to find savings accounts that pay interest rates up to 5%, but they do exist. Here's how to find the best savings accounts that pay up to 5%. Grow your personal savings with a high-yield savings rate—NaN APY. Open How to Calculate Interest Earned on a Savings Account. Article | January In any month the amount of accrued interest is less than $, periodic statements will show no Annual Percentage Yield Earned (APYE) or interest earned though. Open a Bask Interest Savings Account online in 15 minutes or less. Start earning % APY with no monthly account fees. No monthly maintenance fees or minimum balance requirements. · Your money earns money with interest compounded daily. · Earn more than 5x the national average. The % APY is guaranteed for the first 5 months after account opening. After the promotional period, the account will earn the posted interest rate of the. Your interest begins to accrue no later than the business day we receive credit for the deposit of non-cash items (for example, checks). Interest on your.

Best Trading Robot Mt4

We recommend the GPS Forex Robot, particularly for its impressive 98% winning trade rate claim. The system boasts a minimal drawdown of just 7% when trading. 1. MetaTrader 4 nas scalping EA. Introducing the ultimate EA for traders looking to profit from short-term price movements in the NAS Best Robots for Forex Trading · 1. Best for Unique Features: Forex Fury · 2. Best for State of the Art Algorithm: pip Climber System · 3. Best for Traders. Flexibility: Flex EA is an automated trading robot that can be setup to trade just about any trading strategy imaginable. All 3 memberships will include all Top best forex robot for metatrader 4 · 1. Forex Fury – Best Trading Robot for MT4 · 2. BOTS Live Trading Room · 3. pip Climber System –. Available now the Mt4 EA forex robot named Goldfinger is one of our exclusive robots. The currency robot is able to make trades using up to 4 different trading. Get the best mt4 bot services · Code a trading bot for mt4 or mt5 · Mt5 trading bot, mt4 eas bot, mt5 eas bot, mt4 eas robot, mt4 trading bot · Develop forex bot. Compare and read user reviews of the best Forex Robots currently available using the table below. This list is updated regularly. FXParabol EA is a system that might be called mathematical genius among Forex robots. This automated Forex trading robot uses an amazing combination of. We recommend the GPS Forex Robot, particularly for its impressive 98% winning trade rate claim. The system boasts a minimal drawdown of just 7% when trading. 1. MetaTrader 4 nas scalping EA. Introducing the ultimate EA for traders looking to profit from short-term price movements in the NAS Best Robots for Forex Trading · 1. Best for Unique Features: Forex Fury · 2. Best for State of the Art Algorithm: pip Climber System · 3. Best for Traders. Flexibility: Flex EA is an automated trading robot that can be setup to trade just about any trading strategy imaginable. All 3 memberships will include all Top best forex robot for metatrader 4 · 1. Forex Fury – Best Trading Robot for MT4 · 2. BOTS Live Trading Room · 3. pip Climber System –. Available now the Mt4 EA forex robot named Goldfinger is one of our exclusive robots. The currency robot is able to make trades using up to 4 different trading. Get the best mt4 bot services · Code a trading bot for mt4 or mt5 · Mt5 trading bot, mt4 eas bot, mt5 eas bot, mt4 eas robot, mt4 trading bot · Develop forex bot. Compare and read user reviews of the best Forex Robots currently available using the table below. This list is updated regularly. FXParabol EA is a system that might be called mathematical genius among Forex robots. This automated Forex trading robot uses an amazing combination of.

Code Base is a free library of trading robots and indicators built directly into MetaTrader 4. Market is a store of indicators and Expert Advisors that. The most profitable expert advisors in ⭐ Live statistics ✓ Backtests ✓ Forex Trendy ✓Forex Store rating systemnull. Use the comparison tool below to compare the top Forex Robots with a Free Trial on the market. You can filter results by user reviews, pricing, features. Check out our forex robot mt4 selection for the very best in unique or custom, handmade pieces from our computers shops. Find the best mt4 bot services you need to help you successfully meet your project planning goals and deadline. Best Robots for Forex Trading · 1. Best for Unique Features: Forex Fury · 2. Best for State of the Art Algorithm: pip Climber System · 3. Best for Traders. 1. FX Fury. This has to be one of the most popular forex robots on our list. It makes daily trades with. I am currently testing the same bot on a demo account and the results currently seem too good to be true. Which I know means it likely is. I. Forex Fury is an automated trading robot for MT4 & MT5 with LIVE verified trading results, a proven winning track record of 93% and hundreds of strategies. The Alpha Trend Trading EA is a professional forex trading robot designed to enhance trading performance by Silent 0. Best forex robot overall: Odin Forex Robot. Odin has quickly become the best forex ea of It's the top choice for professionals right now. Introducing the Forex Trading Signals Robot: Your Ultimate Forex Companion Main Features: Auto Trading system for Forex users. You just need to provide info. Forex trading bots, also known as Expert Advisors (EAs) in MT4, are automated systems designed to execute trades on behalf of the trader. They follow a set of. Best Forex EAs – Forex Expert Advisors Rating ; Tickeron AI robot · Learn2Trade · Auto Recovery EA · Coinrule ; · · · Use the comparison tool below to compare the top Forex Robots on the market. You can filter results by user reviews, pricing, features, platform, region. A good EA can be picked up for anywhere between $-2k$ depending on complexities. There are EA's like Waka Waka that have been profitable (With REAL MONEY. Many experienced traders share their insights and knowledge on these platforms, making it easier to connect with potential mentors. 3. Forex seminars and events. The Alpha Trend Trading EA is a professional forex trading robot designed to enhance trading performance by Silent 0. Top 10 Forex Robots in ; ECON POWER TRADER. % mo. N/A ; FOREX KORE EA. % mo. N/A ; FOREX DIAMOND EA. % pa. mins ; FX GOODWAY. % pa. N/A. Flexibility: Flex EA is an automated trading robot that can be setup to trade just about any trading strategy imaginable. All 3 memberships will include all

Gme Remittance

Send and receive money worldwide with IME Remit, Nepal's top remittance company. Over 20 years of trusted service and global partnerships. GME Remit · 1. Original VIPER. 앱 개발 초기에 사용한 VIPER 아키텍쳐로 각 모듈간 통신은 프로토콜을 사용한다. 사용모듈 · 2. VIPER + ViewModel (RxSwift) · 3. VIPER +. We are licensed by the Ministry of Strategy & Finance to operate as the first Non-Bank Remittance Service provider in South Korea. [*GME APP SERVICE*]. Himal Remit. IPAY Remit. Kumari Remit. Prabhu Remit. Remit To Nepal. Samsara Remit. Money Gram. Esewa. City express. ime pay. western union. GME Remit. " provided us with concrete data to analyze our rotations, monitor our work hours, submit state GME reporting and invoice our affiliate hospitals. GME's info · The Markets - market coupling · Results & Statistics · Results · Statistics · IG Index GME · Monitoring & Remit. Forward Electricity Accounts (PCE). Send money to SENEGAL this September with GME and enjoy great rates and low service fees! It's easy for loved ones to receive money securely through GME Remit. Whether for a birthday, holiday or any other occasion, Remitly offers flexibility when it. Followers, 27 Following, Posts - GME Remittance (@gmeremitofficial) on Instagram: "The #1 remittance company in South Korea! Send and receive money worldwide with IME Remit, Nepal's top remittance company. Over 20 years of trusted service and global partnerships. GME Remit · 1. Original VIPER. 앱 개발 초기에 사용한 VIPER 아키텍쳐로 각 모듈간 통신은 프로토콜을 사용한다. 사용모듈 · 2. VIPER + ViewModel (RxSwift) · 3. VIPER +. We are licensed by the Ministry of Strategy & Finance to operate as the first Non-Bank Remittance Service provider in South Korea. [*GME APP SERVICE*]. Himal Remit. IPAY Remit. Kumari Remit. Prabhu Remit. Remit To Nepal. Samsara Remit. Money Gram. Esewa. City express. ime pay. western union. GME Remit. " provided us with concrete data to analyze our rotations, monitor our work hours, submit state GME reporting and invoice our affiliate hospitals. GME's info · The Markets - market coupling · Results & Statistics · Results · Statistics · IG Index GME · Monitoring & Remit. Forward Electricity Accounts (PCE). Send money to SENEGAL this September with GME and enjoy great rates and low service fees! It's easy for loved ones to receive money securely through GME Remit. Whether for a birthday, holiday or any other occasion, Remitly offers flexibility when it. Followers, 27 Following, Posts - GME Remittance (@gmeremitofficial) on Instagram: "The #1 remittance company in South Korea!

View GME Remittance revenue, competitors and contact information. Find and reach GME Remittance's employees by department, seniority, title, and much more. JME offers speedy money transfer service from Japan to various part of the world. Depending upon the service availability to your desired location. United Arab Emirates. . EEC. Taiwan. EMQ Send. Taiwan. Far East Remit. Taiwan. Fastpay. Taiwan. GME Remittance. South Korea. Global Remit. Israel. GmoneyTrans. △ · img. GME. $ △ · img. LUMN. $ △ · img. LOT. $ △ Fastest remittance. STEP 1. Download the INDmoney app and create your free. GME Remittance is a leading provider of money transfer services, operating primarily in the financial services industry. GME stock surged by over 1,% in a month. His recent post has also sparked The initiative aimed to promote financial inclusion, streamline remittance. For a seamless experience, please transact only with GCash's officially accredited remittance partners. Tap to view the official GCash GME Remittance Hanpass. Apps · Movies & TV · Books · Kids. Image. GMERemittance. GME Remit. More by GMERemittance. Icon image GME Remit. GME Remit. star. Additional Information. GME Remit primarily focuses on remittances. They ensure that users can send money across borders without any hitches. It also offers competitive exchange rates. Parbhu Money Transfer · IME · City Express · Himal Remit · Parbhu Money Transfer · Reliable Remit · I Pay Remit · GME Remittance. GME Remittance India, Seoul, Korea. likes · 41 talking about this. Through GME Remit app: You can Send Money to India 1) First Transaction is free. Log in. Open app. gmeremitofficial's profile picture. gmeremitofficial. •. Follow. Photo by GME Remittance on July 30, May be an image of. Transfer money from Korea to Myanmar. Use GME Remit to send money to CB Bank accounts. Who is GME. Endorsed by the government, GME has always been committed to combining financial technology with customers' actual overseas remittance needs. GME Remit. Remitly. XOOM. I have a Korean remittance account set up already that I usually use (through Nonghyup, haven't switched it to my KEB. GME Remittance - Nepal | followers on LinkedIn. Sending money to Nepal made much more easier! | GME Remittance Nepal is an established performer in the. United Arab Emirates. . EEC. Taiwan. EMQ Send. Taiwan. Far East Remit. Taiwan. Fastpay. Taiwan. GME Remittance. South Korea. Global Remit. Israel. GmoneyTrans. GME Limited was established as a licensed Money Service Operator (Remittance Agents and Money Changers) with a unique operating philosophy of providing. It's easy for loved ones to receive money securely through GME Remit. Whether for a birthday, holiday or any other occasion, Remitly offers flexibility when it. Get ready to celebrate Dashain early with ACE Money Transfer & GME Remittance. Send your hard-earned money to Nepal with ACE Money Transfer. Use promo code.

Pay Off House With 401k

When you withdraw funds from pre-tax retirement accounts to pay off a home loan, you typically create a substantial tax bill. Those costs may offset any. “Payoff the mortgage as fast as possible! Your damn hair is on FIRE! Debt is the spawn of SATAN! Once the house is paid off you will have enormous cash flow! "If you withdraw money from a (k) or an individual retirement account (IRA) before 59½, you'll likely pay ordinary income tax—plus a penalty. Cashing out your retirement plan to make this happen isn't a good idea. I love that you want to get rid of your car payment, but if you use your (k) they'll. The greatest caveat to using (k) funds to eliminate a mortgage balance is the stark reduction in total resources available to you during retirement. True. If you are regularly investing in a retirement account, whether that's a (k) or an IRA, one solution could be to lower your contribution amount and redirect. No, you should not reduce your k contribution to pay for a car or to pay off a house sooner. And here's why. If you reduce your k. Taking money out of a (k) or an IRA to pay off your mortgage is almost always a bad idea if you haven't reached age 59½. You'll owe penalties and income. Unfortunately, while it's better to pay a mortgage off, or down, earlier, it's also better to start saving for retirement earlier. Thanks to the joys of. When you withdraw funds from pre-tax retirement accounts to pay off a home loan, you typically create a substantial tax bill. Those costs may offset any. “Payoff the mortgage as fast as possible! Your damn hair is on FIRE! Debt is the spawn of SATAN! Once the house is paid off you will have enormous cash flow! "If you withdraw money from a (k) or an individual retirement account (IRA) before 59½, you'll likely pay ordinary income tax—plus a penalty. Cashing out your retirement plan to make this happen isn't a good idea. I love that you want to get rid of your car payment, but if you use your (k) they'll. The greatest caveat to using (k) funds to eliminate a mortgage balance is the stark reduction in total resources available to you during retirement. True. If you are regularly investing in a retirement account, whether that's a (k) or an IRA, one solution could be to lower your contribution amount and redirect. No, you should not reduce your k contribution to pay for a car or to pay off a house sooner. And here's why. If you reduce your k. Taking money out of a (k) or an IRA to pay off your mortgage is almost always a bad idea if you haven't reached age 59½. You'll owe penalties and income. Unfortunately, while it's better to pay a mortgage off, or down, earlier, it's also better to start saving for retirement earlier. Thanks to the joys of.

If you haven't saved enough for retirement or put a premium on investing: If you're not maxing out contributions to your (k), IRA or other retirement. In that case, you may have up to 25 years depending on your (k) plan. You also: Need to estimate your monthly house payment? Use our mortgage calculator. Seems that's enough to seek better options. Compare the interest rate you're paying on the mortgage with what you're earning in the k, for example. Maybe. With the increased standard deduction, coupled with the mortgage and home equity interest limitations, paying off the mortgage can also make sense for a more. Loans and withdrawals from workplace savings plans (such as (k)s or (b)s) are different ways to take money out of your plan. I'm investigating taking a $50k k LOAN out of my k, total k balance $k, to pay down the principle on my house to save myself from paying interest. If your employer is willing to match your (k) contributions, it may be worth it to take this free money, which can make up for the interest you'll accumulate. In that case, you may have up to 25 years depending on your (k) plan. You also: Need to estimate your monthly house payment? Use our mortgage calculator. Step 4: Pay off any credit card debt. If you've been carrying balances on any credit cards, now is the time to start chipping away at them by paying more. Experts agree early retirement withdrawals and (k) loans should be a last resort. If you can cover necessary expenses like rent/mortgage payments, medical. How to pay off your mortgage early · Refinance to a shorter-term loan · Pay extra on your principal · Don't over-do it. The CARES Act has made it easier than ever for some individuals to tap retirement funds for paying off their mortgage debt. It is just important to make. Annual return on retirement account investments: 8%. Annual wage growth: 2%, starting in the second year of the calculation. Additional loan payments apply to. Tapping retirement funds to pay debt may have short- and long-term drawbacks. · If you are facing a hardship, you may be eligible to withdraw some of your (k). If you haven't saved enough for retirement or put a premium on investing: If you're not maxing out contributions to your (k), IRA or other retirement. Cashing out your retirement plan to make this happen isn't a good idea. I love that you want to get rid of your car payment, but if you use your (k) they'll. An advantage of a (k) loan over a withdrawal is you don't pay ordinary income taxes or face potential additional taxes on the borrowed amount. You must repay. Setting up a separate savings account and gradually building up enough for a down payment is a great idea. Even in the midst of saving for a home, most people. Generally, the employee must repay a plan loan within five years and must make payments at least quarterly. The law provides an exception to the 5-year. Well 4 years ago, they announced that they were going to pay off the mortgage on their home by cashing in a big part of his k. I tried to.

Thinkful Data Analytics Review Reddit

I'm currently enrolled in the springboard data science boot camp. Reddit · reReddit: Top posts of May 5, CareerFoundry Data Analytics Bootcamp Review | Bootcamp + Intro + Free Course Review data analytics bootcamp via Thinkful. I'm happy. I believe thinkful's upfront tuition is $10k? But even at half the price of codesmith or hackreactor, the outcomes data is so markedly low it. votes, comments. I'm officially admitted and supposed to start the Springboard Data Science career track in about a week. data visualization techniques. Reviews for Coding Dojo's data science program are mixed, especially on platforms like Reddit. While some former students did. Thinkful -App Academy (this is the one that offers their full curriculum) I am trying mainly to get into data analytics. Upvote 1. Downvote. I was just "accepted" to start Thinkful's bootcamp for data science. I felt like my point of contact was earnest in communicating with me, but am skeptical of. Also, were you considering taking the Data Analytics Course or the Data Science Boot Camp? I went with Thinkful. It's been a couple. % scam. Coding and data science bootcamps are incredibly predatory, and they need to be regulated. I'm currently enrolled in the springboard data science boot camp. Reddit · reReddit: Top posts of May 5, CareerFoundry Data Analytics Bootcamp Review | Bootcamp + Intro + Free Course Review data analytics bootcamp via Thinkful. I'm happy. I believe thinkful's upfront tuition is $10k? But even at half the price of codesmith or hackreactor, the outcomes data is so markedly low it. votes, comments. I'm officially admitted and supposed to start the Springboard Data Science career track in about a week. data visualization techniques. Reviews for Coding Dojo's data science program are mixed, especially on platforms like Reddit. While some former students did. Thinkful -App Academy (this is the one that offers their full curriculum) I am trying mainly to get into data analytics. Upvote 1. Downvote. I was just "accepted" to start Thinkful's bootcamp for data science. I felt like my point of contact was earnest in communicating with me, but am skeptical of. Also, were you considering taking the Data Analytics Course or the Data Science Boot Camp? I went with Thinkful. It's been a couple. % scam. Coding and data science bootcamps are incredibly predatory, and they need to be regulated.

Experience with a for-profit data science bootcamp and have seen review and accreditation. So lots of these students have had poor. I'm currently researching different bootcamps, and leaning towards data analytics with coding dojo. Lol my isa with thinkful is your paying Read our guide to online coding bootcamps like Bloc, Thinkful, Hack Reactor and Career Foundry Reviews. 4. Courses. Save. Online · Cyber Security, Data. Coding Temple is a Chicago-based coding bootcamp that provides online education in data analytics, software engineering, cyber security, and quality assurance. I am currently looking into the Thinkful Data Science certificate program. I am working in a business intelligence role, and have basic experience with Python. Thinkful. (Bonus points if you can give me I'm basically a clean slate because I know nothing about coding, IT, or data analytics etc. I would like to get an entry-level job doing data analysis as quickly as possible. I have an unrelated (non-STEM) bachelor's degree and run. There are lots of developer jobs in lots of fields: non profits, open source, machine learning, data analysis, and so much more. Honing in. 55 votes, 81 comments. I have been thinking of applying for the U of M data bootcamp. I want to hear more recent reviews from people or any. I joined THINKFUL when they did ISA. If you like reading do the course but if not You will learn more on ANY OF THE FREE source the guy posted above. I'm having trouble finding reviews on the Data Analysis tusfrases.ru). She was really kind. What I am wondering: Are there any recommended or industry leading data analytics boot camps? -Thinkful, Flatiron, Springboard, and General. Thinkful, Springboard, Flatiron School, Coding Dojo, etc? These boot camps Review the bootcamp's curriculum and course content carefully. Ensure. I'm more on the Data Analytics/Python (BS/MS Math) side of thing. Reddit · reReddit: Top posts of August · Reddit · reReddit: Top posts. data science boot camps like Thinkful, Springboard, Flatiron School, Coding Dojo, etc? These boot camps are only about $10, and require. I am in the process of possibly starting a data analytics boot camp at the University of Oregon, I've done some comparison to other institutions, and pricing/. However, when I look at some of the reviews it really seems like people like the bootcamps. Analyst, information security engineer? 32 votes, 29 comments. I've been looking at data science bootcamps, and every single one seems to have great reviews, 4+ star ratings. I am thinking about going into Springboard data analytics boot camp. Got no prior experience in analytics but am willing to put in the work as i know these.

1 2 3 4 5 6