tusfrases.ru

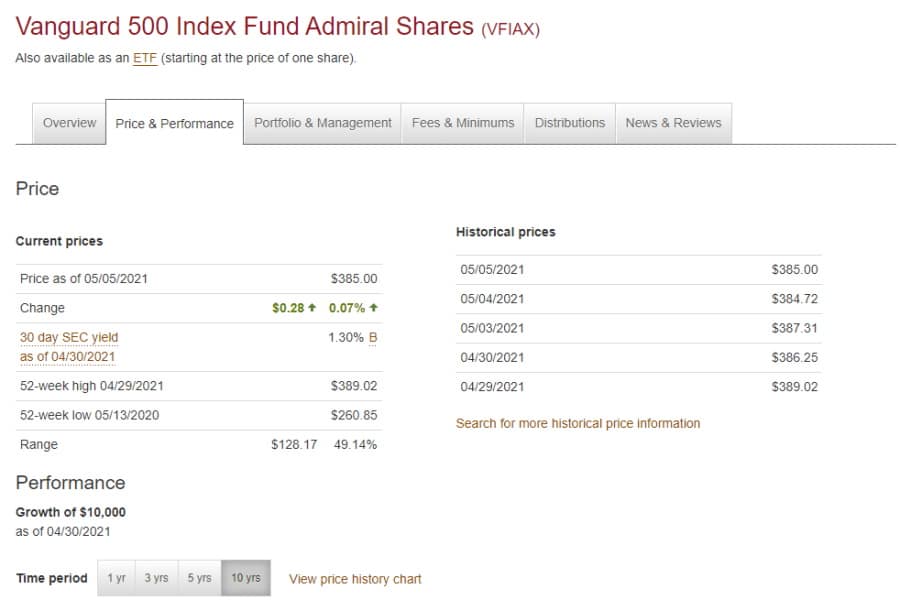

Prices

Definition Of Blue Collar

Of, relating to, or designating manual industrial workers → Compare white-collar, pink-collar. Click for pronunciations, examples sentences, video. What Is Blue-Collar Crime? Blue-collar crime is a term used to describe crimes that are committed primarily by people who are from a lower social class. This is. relating to people who do physical work rather than mental work, and who usually do not work in an office: blue-collar. The phrase stems from manual workers' image of wearing blue denim or chambray shirts as part of their dresses. Industrial and manual employees often wear sturdy. Blue-Collar Workers are those workers in private and public sector employment who engage in manual labor or the skilled trades. A blue-collar worker can be. Blue collar is a term used to identify people who do manual labor and are paid on an hourly or daily basis. In other words, they do not receive a fixed monthly. The blue collar worker definition indicates that these workers perform primarily manual labor. Other similar classifications include white collar, pink collar. Blue-collar workers work in industry, doing physical work, rather than in offices. [ ] See full entry for. Blue-collar definition: of or relating to wage-earning workers who wear work clothes or other specialized clothing on the job, as mechanics, longshoremen. Of, relating to, or designating manual industrial workers → Compare white-collar, pink-collar. Click for pronunciations, examples sentences, video. What Is Blue-Collar Crime? Blue-collar crime is a term used to describe crimes that are committed primarily by people who are from a lower social class. This is. relating to people who do physical work rather than mental work, and who usually do not work in an office: blue-collar. The phrase stems from manual workers' image of wearing blue denim or chambray shirts as part of their dresses. Industrial and manual employees often wear sturdy. Blue-Collar Workers are those workers in private and public sector employment who engage in manual labor or the skilled trades. A blue-collar worker can be. Blue collar is a term used to identify people who do manual labor and are paid on an hourly or daily basis. In other words, they do not receive a fixed monthly. The blue collar worker definition indicates that these workers perform primarily manual labor. Other similar classifications include white collar, pink collar. Blue-collar workers work in industry, doing physical work, rather than in offices. [ ] See full entry for. Blue-collar definition: of or relating to wage-earning workers who wear work clothes or other specialized clothing on the job, as mechanics, longshoremen.

Blue Collar: Blue collar workers are individuals who typically perform manual labor or skilled trades. The term comes from the idea that these. Don't miss a thing! Blue-collar workers are individuals primarily engaged in manual labor or skilled trade occupations. These jobs involve physical work and. Such nonexempt “blue-collar” employees gain the skills and knowledge required for performance of their routine manual and physical work through apprenticeships. Blue collar refers to a working-class job or occupation that has historically been associated with manual labor, particularly related to industrial and. Blue collar workers are those who perform manual labor. The name comes from the early 20th century when these workers wore resistant fabrics of darker colors . Definition of blue-collar adjective in Oxford Advanced Learner's Dictionary. Meaning, pronunciation, picture, example sentences, grammar, usage notes. Blue Collar Workers. A blue collar worker refers to someone whose profession requires them to perform a good amount of manual labor. Some of the. BLUE–COLLAR meaning: requiring physical work relating to or having jobs that require physical work. Blue collar workers are those who perform manual labor. Most workers are paid hourly or have union representation to negotiate labor contracts on their. Referred to as "blue collar workers," the lower class has little economic security and includes both individuals working lower-paying positions and unemployed. Is a worker engaged in manual work, who by tradition wore blue overalls to a job in a factory. Blue-collar workers can be unskilled, semi-skilled. When the term blue-collar was coined in the 19th century, it referred to workers who were employed in manual labour and manufacturing. Nowadays, it also. White Collar are deluded idiots who're gullible enough to believe in "Resources"; Blue Collar means they actually use their hands for good. What is a Blue-Collar Worker? (The definition of a blue-collar worker). A blue-collar worker is an individual who performs manual labor or skilled trades, often. Blue-collar worker definition A term, which some consider pejorative, that is variously used to describe working class people employed as tradesmen or those. Both “blue-” and “white-collar” refer to class distinctions, “blue-collar” referring to the working class, and “white-collar”, to the middle. Blue-collar employees are manual laborers who are often physical, such as construction, automotive repair, welding, or cleaning. The term became popularized. What is a Blue-Collar Worker? (The definition of a blue-collar worker). A blue-collar worker is an individual who performs manual labor or skilled trades, often. blue collar. Making wages above $ an hour and below $, a year. Considered anyone of lower and middle class. A humble person who makes a modest living. blue-collar, adj. & n. meanings, etymology, pronunciation and more in the Oxford English Dictionary.

760 Credit Score Car Loan Rate

loan and a good interest rate. In this article, you will learn: How your credit score affects your eligibility for a car loan; Car loan rates by credit score. NEW AUTO · APR = Annual Percentage Rate. · To qualify for % fixed APR for 60 months requires a FICO score of or greater and member must qualify for Member. The average APR for someone with a credit score is currently % for a new car, and % for a used car. Car Loan Interest Rates for Deep Subprime. What is the Average Interest Rate on a Car Loan? ; , %, , % ; , %, , %. The assumed credit score is At a % interest rate, the APR for the loan type is %. The monthly payment schedule would be: payments of. Finance Your Next Car ; Model Years & Newer Rates as Low as · % APR ; Model Years – Rates as Low as · % APR ; Model Years – Rates as Low. Average Auto Loan Rates for Excellent Credit ; Credit Score, New Car Loan, Used Car Loan ; or higher, %, %. Credit score range. Average interest rate ; to % ; to % ; to % ; to %. The size of your monthly payment depends on loan amount, loan term, and interest rate. Loan amount equals vehicle purchase price minus down payment. loan and a good interest rate. In this article, you will learn: How your credit score affects your eligibility for a car loan; Car loan rates by credit score. NEW AUTO · APR = Annual Percentage Rate. · To qualify for % fixed APR for 60 months requires a FICO score of or greater and member must qualify for Member. The average APR for someone with a credit score is currently % for a new car, and % for a used car. Car Loan Interest Rates for Deep Subprime. What is the Average Interest Rate on a Car Loan? ; , %, , % ; , %, , %. The assumed credit score is At a % interest rate, the APR for the loan type is %. The monthly payment schedule would be: payments of. Finance Your Next Car ; Model Years & Newer Rates as Low as · % APR ; Model Years – Rates as Low as · % APR ; Model Years – Rates as Low. Average Auto Loan Rates for Excellent Credit ; Credit Score, New Car Loan, Used Car Loan ; or higher, %, %. Credit score range. Average interest rate ; to % ; to % ; to % ; to %. The size of your monthly payment depends on loan amount, loan term, and interest rate. Loan amount equals vehicle purchase price minus down payment.

Auto Loan Rates. An auto loan will get you mobile. Finance your next car, truck, minivan, or SUV with us. APPLY NOW VIEW RATES. Average interest rates for car loans ; , , , ; New-car loan, %, %, %, %. 3 - Subject to vehicle type limitations. 4 - Available terms vary based upon automobile age and your credit score. 5 - Interest rate is dependent on loan term. Looking for a new or used vehicle? Black Hills Federal Credit Union provides great South Dakota Auto Loan Rates. View our vehicle loan rates online. The average interest rate for auto loans on new cars is %. The average interest rate on loans for used cars is %. Refinancing your car loan from another lender with New York University Federal Credit Union may help you lower your interest rate, decrease your monthly payment. Best rate available to well-qualified borrowers with a credit score of and above. Your rate may be higher depending on your credit history, loan purpose. Stated “rates as low as % APR” apply to well-qualified applicants with credit scores of , loan terms of 36 months and vehicles with less than 80, If you have below a , you may want to take some time to boost your score. Pay down outstanding credit card bills, correct any errors and make payments on. A FICO® Score is above the average credit score. Consumers in this range may qualify for better interest rates from lenders. In fact, is classified as “excellent credit,” and having a credit score this high should qualify you for good terms on most loans, credit cards and other. A high CIBIL Score of + is an added advantage in getting you a faster easier car loan approval. Banks and lenders prefer consumers with a. Generally speaking, credit scores above are considered 'excellent' by almost all lenders. Anyone having credit scores in the and higher range should. Borrowers with prime credit scores are responsible for the majority of retail vehicle financing. Borrowers with credit scores of and higher account for Minimum credit score of & Loan-to-Value of 90% or less to qualify for advertised APR. Interest rate and APR is determined by credit score and LTV (loan. Credit Score Auto Loan Calculator ; , 0%, 3 Years ; , %, 4 Years ; , %, 5 Years. What is a good car loan rate? Looking at the information above, it can be between % and % depending on your credit score. Negotiating helps if you end. Subject to credit approval with a minimum FICO score of Offer good for loan amounts of $25, - $, Introductory rate of % is fixed for Rates as low as % APR.¹skip to disclosure. Hit the road with low new and used car rates, as well as motorcycles, trucks. If you have below a , you may want to take some time to boost your score. Pay down outstanding credit card bills, correct any errors and make payments on.

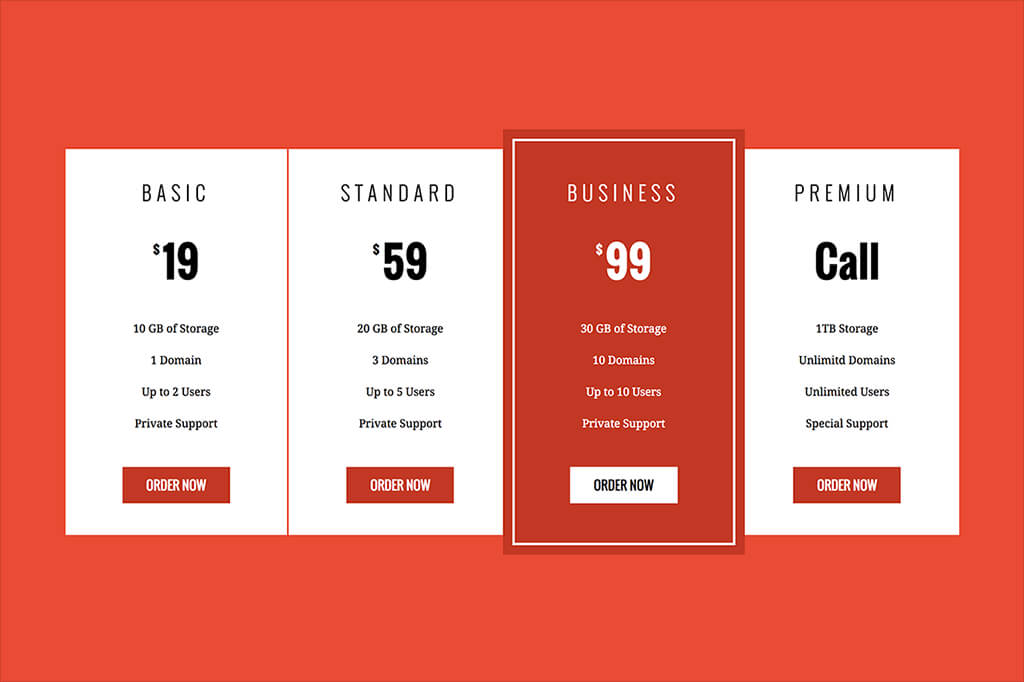

Wordpress India Pricing

Get 4 months free on annual plans, backed by our 60 day money-back guarantee. Power your website on the #1 WordPress hosting platform. Check out our WordPress Hosting Plans. Prices as low as $ with free WPX India, Indonesia, Iraq, Ireland, Isle Of Man, Israel, Italy, Jamaica, Japan. Managed WordPress Deluxe Ideal as you grow, with upgraded resources. You pay $ today. Renews at $ Buy. What You Get When You Buy a WP Rocket License · Broad compatibility with hostings, themes and plugins: The most popular WordPress tools trust us, and this should. Choose a plan today and unlock a powerful bundle of features. Or start with our free plan. tusfrases.ru Plans. Pay yearly. Pay yearly. Pay every 2 years. WordPress installation, click to deploy WordPress Google Cloud's pay-as-you-go pricing offers automatic savings based on monthly usage and discounted rates. In general, As per Jamstacky, the cost of a WordPress website in India can range from a few thousand rupees to several lakhs depending on your. Plans & Pricing. Products. WordPress Hosting · WordPress for Agencies · Domain Migrate unlimited WordPress sites to tusfrases.ru for free and get all. Bottom line: how much does a WordPress website cost in India? · Web hosting. Single WordPress plan from Hostinger costs ₹59 per month. · Domain. Get 4 months free on annual plans, backed by our 60 day money-back guarantee. Power your website on the #1 WordPress hosting platform. Check out our WordPress Hosting Plans. Prices as low as $ with free WPX India, Indonesia, Iraq, Ireland, Isle Of Man, Israel, Italy, Jamaica, Japan. Managed WordPress Deluxe Ideal as you grow, with upgraded resources. You pay $ today. Renews at $ Buy. What You Get When You Buy a WP Rocket License · Broad compatibility with hostings, themes and plugins: The most popular WordPress tools trust us, and this should. Choose a plan today and unlock a powerful bundle of features. Or start with our free plan. tusfrases.ru Plans. Pay yearly. Pay yearly. Pay every 2 years. WordPress installation, click to deploy WordPress Google Cloud's pay-as-you-go pricing offers automatic savings based on monthly usage and discounted rates. In general, As per Jamstacky, the cost of a WordPress website in India can range from a few thousand rupees to several lakhs depending on your. Plans & Pricing. Products. WordPress Hosting · WordPress for Agencies · Domain Migrate unlimited WordPress sites to tusfrases.ru for free and get all. Bottom line: how much does a WordPress website cost in India? · Web hosting. Single WordPress plan from Hostinger costs ₹59 per month. · Domain.

Managed WordPress Hosting · Tiny. Ideal for small, simple installs. $13 Billed at $/year. · Starter. Our most popular single site plan! $25 Billed at $/. IN. IndiaEnglish. IN. भारतहिंदी. ID. IndonesiaBahasa Indo. IT. Italia How Much Do WordPress Plans Cost? Icon. Our Managed WordPress Hosting has. Get Managed WordPress Hosting with FREE Install & Automated Transfer, 24/7 Hosting Support, Auto-updates, CDN & Caching for top speed at a great price! Start earning from day one with paid subscriptions and gated content, with processing fees as low as 0% with paid plans. Optimized for growth. tusfrases.ru's. Discover the powerful features of tusfrases.ru plans. From custom domains to enhanced security, we'll help you find the right plan for your site. Discover the powerful features of tusfrases.ru plans. From custom domains to enhanced security, we'll help you find the right plan for your site. What features are included in each pricing plan? Each MilesWeb WordPress hosting plan is preconfigured with valuable features to help you build and manage your. Is my charges over-priced? cost-effective? or under-priced? Edit: 1- We're located here in India. My clients are 60% Indian while. Average WordPress website development cost in India can range from ₹ $45, to ₹ $20,00,+ ($ to $24,+), depending on the website's complexity and. Generally, WordPress development cost in India vary between 17,INR ($) to 1,00,INR ($). However, depending on the complexity and. Basic WordPress website: A simple, basic WordPress website with a pre-built theme, a few pages, and basic functionality like contact forms. WordPress Pricing Comparison ; Fully Loaded Time, seconds, seconds ; Easy Migration ; Free Backup ; Free SSL, - ; Free CDN. Plans & Pricing. Products. WordPress Hosting · WordPress for Agencies · Domain Migrate unlimited WordPress sites to tusfrases.ru for free and get all. Unlimited Website · Unlimited storage · Free SSL Certificate · + Free Wordpress Themes · Free Speed Boosting CDN CDN (Worth /yr) · Free Domain for 1 Year . – Cost to Build WordPress Website (Business/ eCommerce). Get Low Cost Website Design in India @ Just ₹ with Free Domain, Hosting & Business Email Ids. Most hosts offer an initial free or low-cost period, with discounts when you buy hosting services for two or more years. The next cost is registering a domain. Promotional Pricing DisclaimerOffer for new accounts only. At the end of the purchased term, the price renews at the then-current rate (currently $/mo). WP Engine provides the fastest, most reliable WordPress hosting for M+ websites. Get 24/7 support, best-in-class security, and market-leading. Most hosts offer an initial free or low-cost period, with discounts when you buy hosting services for two or more years. The next cost is registering a domain. Kinsta's WordPress hosting plans start at $30/month with free migrations and a hack fix guarantee, powered by Google Cloud Platform.

Buying A House With Owned Solar Panels

But having a leased solar panel system or Power Purchase Agreement (PPA) could hamper or defeat the sale of your property. How Solar Leases Work. Solar leases. If you own the panels and you bought them outright, your property is immediately more attractive. You will have benefited from free electricity while also. Owning a solar-powered home can help you save on your energy bills, reduce greenhouse gas emissions, and be more energy independent. Researchers have found that potential homebuyers are willing to pay more for homes with customer-owned solar. Homes with an average size solar system sold for a. Solar leases and PPAs allow consumers to host solar energy systems that are owned by solar companies and purchase back the electricity generated. Consumers. How does a transfer of solar panel ownership work? When buying or selling a property with solar panels, the easiest route is to have them fully paid off. This. Homes With Fully-Owned Solar System. The ideal scenario when purchasing a home with a solar system is one that was bought outright by the previous owner. When. While there is a slight variance between the two studies, there's no doubt that solar ownership increases the value of a property and that buyers are willing to. Can solar panels cause issues when buying or selling a property? Yes for both but less so from a seller's point of view. As the buyer, chances are you will need. But having a leased solar panel system or Power Purchase Agreement (PPA) could hamper or defeat the sale of your property. How Solar Leases Work. Solar leases. If you own the panels and you bought them outright, your property is immediately more attractive. You will have benefited from free electricity while also. Owning a solar-powered home can help you save on your energy bills, reduce greenhouse gas emissions, and be more energy independent. Researchers have found that potential homebuyers are willing to pay more for homes with customer-owned solar. Homes with an average size solar system sold for a. Solar leases and PPAs allow consumers to host solar energy systems that are owned by solar companies and purchase back the electricity generated. Consumers. How does a transfer of solar panel ownership work? When buying or selling a property with solar panels, the easiest route is to have them fully paid off. This. Homes With Fully-Owned Solar System. The ideal scenario when purchasing a home with a solar system is one that was bought outright by the previous owner. When. While there is a slight variance between the two studies, there's no doubt that solar ownership increases the value of a property and that buyers are willing to. Can solar panels cause issues when buying or selling a property? Yes for both but less so from a seller's point of view. As the buyer, chances are you will need.

On the other hand, owned solar panels are those the homeowner has purchased outright. Therefore, if you're buying a home with solar panels, you will own the. Power Purchase Agreements (PPAs) are akin to solar leases in that they enable the solar installer to own the panels, while the homeowner enjoys solar energy. If you buy or finance your solar panels, the Energy Policy Act provides tax incentives that can reduce the total installation cost. Leasing does not. It's part of the inspection of the property. You can also condition the purchase to the removal of the solar panels prior to closing and not assume the lease or. If you're looking for a home with solar panels, you'll need to be sure that the panels are included with the sale. Many lease agreements allow current owners to. It's part of the inspection of the property. You can also condition the purchase to the removal of the solar panels prior to closing and not assume the lease or. But, if they are owned outright then there's no loan and they are treated as a part of the real estate, a fixture of the property. However, if there's a loan on. Buyers need to understand the status of solar panels when purchasing a home. It may affect their offer or their ability to get a mortgage. In the case of leased. Homeowners who install solar power systems can receive numerous benefits: reduced electric bills, lower carbon footprints, and potentially higher home values. What to consider if you are thinking of buying a property with leased solar panels You should ask for a copy of the lease early on before you commit money to. How does a transfer of solar panel ownership work? When buying or selling a property with solar panels, the easiest route is to have them fully paid off. This. Homes with owned solar panels are valuable on the market. On average, a solar energy system can add around $15, to a house's sale price. Going forward, homes. Seller who purchase a solar system outright with cash own the system. That's the simplest scenario in a real estate transaction. A solar system purchased. You may find that you are prohibited from developing your own property until the expiry of the lease. Do the panels generate any meaningful income? Smaller. While there is a slight variance between the two studies, there's no doubt that solar ownership increases the value of a property and that buyers are willing to. Leased panels, owned by a third party will not be viewed as real property by appraisers and banks. For this reason, they will not add value to your home. One. If you buy solar panels outright you'll get the most benefits and added home value through more lifetime savings and reducing your reliance on fossil fuels. It depends. If the former house owner owned the panels then they go with the house and since you are now the house owner, then you own the. You may find that you are prohibited from developing your own property until the expiry of the lease. Do the panels generate any meaningful income? Smaller.

What Is The Number One Stock To Invest In

Barchart ranks best and worst performing stocks to buy by highest weighted alpha (measure of how much a stock has changed in the one year period). Can AI and tech stocks keep on keeping on? · THE BID PODCAST. Best of: A history of investing in AI · ACTIVE FIXED INCOME. Let's get real (rates)! · Weekly market. In late , JPMorgan named Alphabet a "top stock" for , citing improving ad growth, higher margins following successful cost cuts, and, of course. The best part? You don't have to be a millionaire and can start investing in minutes. Learn More. 2. Look. ETF Rank. The Zacks ETF Ranking system was designed specifically for Exchange-Traded Funds in order to help you pick the best product for your investing needs. Top Penny Stock Gainers ; CURR. Currenc Group ; FLUX. Flux Power Holdings ; GRYP. Gryphon Digital Mining ; BKSY. BlackSky Technology. The best stocks for beginners are companies with recognizable brands and products that are consistently profitable and generate steady or growing revenue. Number of deals - most sold shares ; 1, NVIDIA Corp ; 2, RR. Rolls Royce Holdings Plc ; 3, IAG, International Consolidated Airlines Group SA ; 4, LLOY, Lloyds. While there are several candidates for best stock picker of the modern era, Warren Buffett is often heralded as the most prominent. Why Is Stock Picking So. Barchart ranks best and worst performing stocks to buy by highest weighted alpha (measure of how much a stock has changed in the one year period). Can AI and tech stocks keep on keeping on? · THE BID PODCAST. Best of: A history of investing in AI · ACTIVE FIXED INCOME. Let's get real (rates)! · Weekly market. In late , JPMorgan named Alphabet a "top stock" for , citing improving ad growth, higher margins following successful cost cuts, and, of course. The best part? You don't have to be a millionaire and can start investing in minutes. Learn More. 2. Look. ETF Rank. The Zacks ETF Ranking system was designed specifically for Exchange-Traded Funds in order to help you pick the best product for your investing needs. Top Penny Stock Gainers ; CURR. Currenc Group ; FLUX. Flux Power Holdings ; GRYP. Gryphon Digital Mining ; BKSY. BlackSky Technology. The best stocks for beginners are companies with recognizable brands and products that are consistently profitable and generate steady or growing revenue. Number of deals - most sold shares ; 1, NVIDIA Corp ; 2, RR. Rolls Royce Holdings Plc ; 3, IAG, International Consolidated Airlines Group SA ; 4, LLOY, Lloyds. While there are several candidates for best stock picker of the modern era, Warren Buffett is often heralded as the most prominent. Why Is Stock Picking So.

Join the millions of people using the tusfrases.ru app every day to stay on top of the stock market and global financial markets! By investing in more than one You'll be exposed to significant investment risk if you invest heavily in shares of your employer's stock or any individual. We've put together a complete, step-by-step guide to help you choose the best stocks in your chosen market. Stock trader Source: Bloomberg. Fortinet and Kellanova rank among the best stocks for the month, while the worst include Intel and Moderna. Bella Albrecht Sep 3, We rank or compare stocks based on popular investment metrics and strategies to help you sort through companies from all major US equity markets. Quick Look at Best Stocks for Day Trading: · Nvidia Corp. (NVDA) · ProShares UltraPro Short (SQQQ) · See All 15 Items. Stocks usually are one part of an investor's holdings. The risks of stock holdings can be offset in part by investing in a number of different stocks. Companies on this list represent the 20 most popular stocks of the community, updated monthly. Note: This is not investment advice. Danelfin is a stock analytics platform powered by AI. It helps investors to pick the best stocks, optimize their portfolios, and make smart data-driven. one style could cause you to miss important clues about a stock's prospects. And because the intended duration of an investment or trade may change, using. Discover Zacks top 10 stocks as hand-picked by our analyst team. Receive a research report of the top 10 stocks. Updates, web access & email alerts for top. Stocks: Most Actives · Stocks: Gainers · Stocks: Losers · Trending Tickers · Futures · World Indices · US Treasury Bonds Rates · Currencies · Crypto · Top ETFs. List of US Stocks to Buy in · 1) Apple Inc. (AAPL) · 2) Microsoft Corporation (MSFT). Microsoft is a multinational technology company established in The Class A shares of Berkshire Hathaway command the top position, with an impressive stock price of over half a million dollars. Swiss chocolatier. Best of: A history of investing in AI. Before the age of self-driving cars When you invest in stocks (also called equities), you buy a share in a. From Apple & Amazon to Netflix & Tesla, here is a list of the most popular stocks by top companies. Explore the list & download the app to get started. tusfrases.ru offers a set of financial tools covering a wide variety of global and local financial instruments. A one-stop-shop for traders and investors. According to the Pew Research Center, even among families who earn less than $35, per year, one-in-five have assets in the stock market. Investing is less. The investor in a short position will profit if the price of the stock falls. Top five contributors - Top five industries in a portfolio based on amount of. Owning individual stocks. What is the best way to invest when you have thousands of stocks to choose from? Your financial advisor looks at the following.

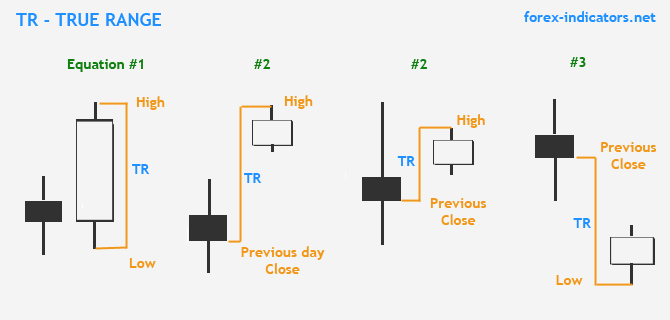

How To Find The Average True Range Of A Stock

Calculated as the moving average of the True Range - the greatest of the current high minus the low, the absolute value of the current high minus the previous. A metric used in financial analysis known to be the ATR gauges the rapidity of price movement for a commodity or securities. J. Welles Wilder published in New. Average true range values are generally calculated based on 14 periods. The period can be monthly, weekly, daily, or even intraday. A high value of average. By default, the average true range is a period Wilder's moving average of this value; both the period and the type of moving average can be customized using. The average true range (ATR) measures the volatility of a security, and it can be one of the many tools used to research stocks and to spot breakouts. When previous bar's close C1 is higher than current bar's high H, true range equals previous bar's close less current bar's low L. An example of such situation. ATR, or Average True Range, is a technical indicator that can tell you how volatile a stock has been, on average, over a specified period. Average True Range (ATR) provides info about a stock's typical daily movement (volatility) over a recent period of time (often the last 14 trading days). ATR is an absolute value and not a percentage. A dollar stock will have ATR values double those of a 50 dollar stock assuming both are equally volatile. Calculated as the moving average of the True Range - the greatest of the current high minus the low, the absolute value of the current high minus the previous. A metric used in financial analysis known to be the ATR gauges the rapidity of price movement for a commodity or securities. J. Welles Wilder published in New. Average true range values are generally calculated based on 14 periods. The period can be monthly, weekly, daily, or even intraday. A high value of average. By default, the average true range is a period Wilder's moving average of this value; both the period and the type of moving average can be customized using. The average true range (ATR) measures the volatility of a security, and it can be one of the many tools used to research stocks and to spot breakouts. When previous bar's close C1 is higher than current bar's high H, true range equals previous bar's close less current bar's low L. An example of such situation. ATR, or Average True Range, is a technical indicator that can tell you how volatile a stock has been, on average, over a specified period. Average True Range (ATR) provides info about a stock's typical daily movement (volatility) over a recent period of time (often the last 14 trading days). ATR is an absolute value and not a percentage. A dollar stock will have ATR values double those of a 50 dollar stock assuming both are equally volatile.

After all, Wilder was interested in measuring the distance between two points, not the direction. If the current period's high is above the prior period's high. First look for a weekly chart where the ATR and volatility is at multi-year lows. Next identify the range in price during this period, or the strongest support. As a result, if an asset's ATR is $, its price has an average daily range of fluctuation of $ Technical analysis with moomoo. Moomoo stock trading app. You have to divide by previous bar's close price. Example: the stock X was traded yesterday at close at $2 per share (previous day close = $2). Today at the. Average True Range is a continuously plotted line usually kept below the main price chart window. The way to interpret the Average True Range is that the higher. The average true range (ATR) formula is fundamental in financial technical analysis, playing a vital role in understanding market volatility. It involves. The first step in calculating ATR is to find a series of true range values for a security. The price range of an asset for a given trading day is simply its. The ATR measures the volatility of a stock over a given set period. It is a complex calculation that takes the highest high or the highest low. Average Day Range (ADR) only looks at how much the price moves between the high and low on a given day. This is the Day Range or DR, which is when averaged to. The Average True Range (ATR) is a technical indicator used primarily to measure volatility in financial markets. Calculation · Most recent period's high minus the most recent period's low · Absolute value of the most recent period's high minus the previous close · Absolute. Average True Range (ATR) is a technical analysis indicator developed by J. Welles Wilder, based on trading ranges smoothed by an N-day exponential moving. The indicator known as average true range (ATR) can be used to develop a complete trading system or be used for entry or exit signals as part of a strategy. Average True Range Technical Indicator (ATR) is an indicator that shows volatility of the market. It was introduced by Welles Wilder in his book New concepts. To calculate the ATR, you would typically take the average of the True Range values over the day period. In this case, you would sum up the True Range values. Story Highlights · The average true range (ATR) is a great tool for determining the level of volatility across stocks to align your investment choices with your. By default, the average true range is a period Wilder's moving average of this value; both the period and the type of moving average can be customized using. In addition, it can applied to any financial market that shows volatility, in particular, stocks, currency pairs and indices. The average true range is plotted. Calculating Average True Range · Current high price minus the current low price · Current low price minus the previous close price · Current high price minus the. Welles Wilder described these calculations to determine the trading range for a stock or commodity. True Range is defined as the largest of the following.

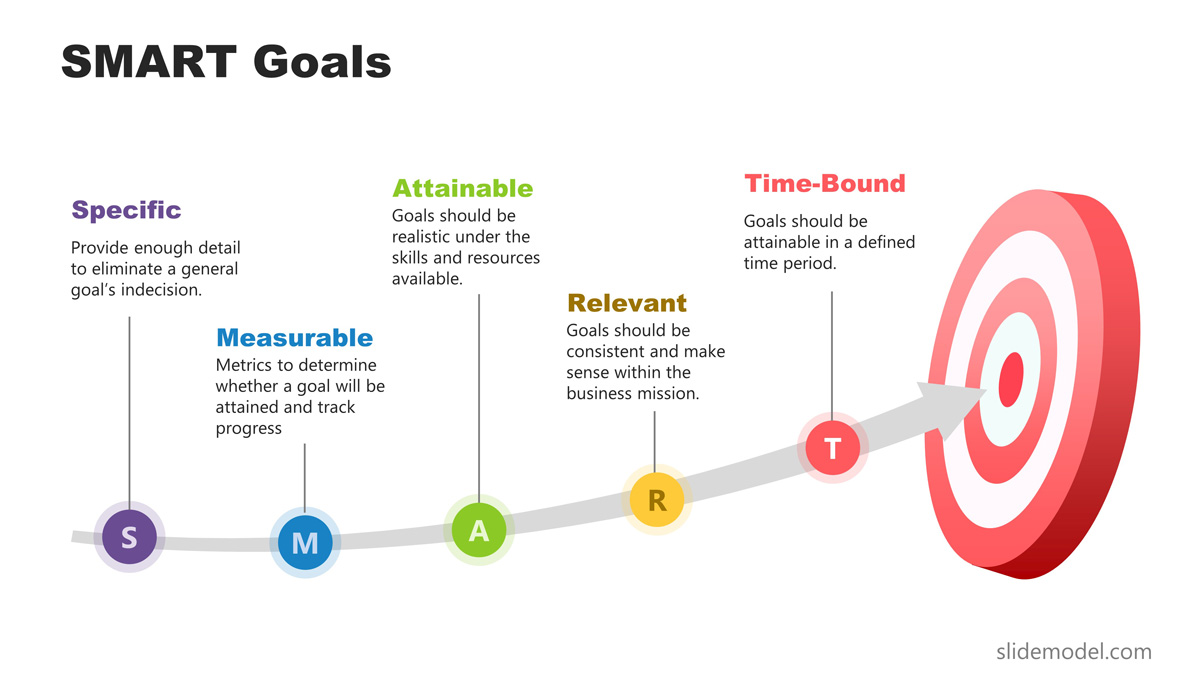

Smart Goals For Logistics

Strategic planning goals involve developing long-term visions for the supply chain that align with the company's business objectives. This could mean expanding. SMART Goals - Detailed Steps · S -- Specific · M -- Measurable · A -- Attainable · R -- Relevant · T -- Time-Bound. Use the SMART Goals View to create specific, measurable, achievable, relevant, and time-bound goals; The Goal Effort View will help you prioritize goals based. To achieve this, they must create goals and objectives that are specific, measurable, attainable, relevant, and time-bound (SMART). SMART Goal Setting System! Specific; Measurable; Attainable; Relevant; Time bound logistics, freight brokerage, business growth strategies and B2B sales. Objectives in this context represent the overarching goals that a company aims to achieve within its supply chain operations, such as improving efficiency. SMART is an acronym that stands for Specific, Measurable, Achievable, Relevant, and Time-bound. It provides a comprehensive framework for setting objectives. "The Goal" by Eliyahu Goldratt is a must-read novel for logistics operations managers who want to optimize their organization's performance and achieve their. Specific – When setting a goal for your supply chain, you must be as specific and clear as possible. · Measurable – When drafting a goal, ask yourself what. Strategic planning goals involve developing long-term visions for the supply chain that align with the company's business objectives. This could mean expanding. SMART Goals - Detailed Steps · S -- Specific · M -- Measurable · A -- Attainable · R -- Relevant · T -- Time-Bound. Use the SMART Goals View to create specific, measurable, achievable, relevant, and time-bound goals; The Goal Effort View will help you prioritize goals based. To achieve this, they must create goals and objectives that are specific, measurable, attainable, relevant, and time-bound (SMART). SMART Goal Setting System! Specific; Measurable; Attainable; Relevant; Time bound logistics, freight brokerage, business growth strategies and B2B sales. Objectives in this context represent the overarching goals that a company aims to achieve within its supply chain operations, such as improving efficiency. SMART is an acronym that stands for Specific, Measurable, Achievable, Relevant, and Time-bound. It provides a comprehensive framework for setting objectives. "The Goal" by Eliyahu Goldratt is a must-read novel for logistics operations managers who want to optimize their organization's performance and achieve their. Specific – When setting a goal for your supply chain, you must be as specific and clear as possible. · Measurable – When drafting a goal, ask yourself what.

How smart is the SMART acronym? · Specific: Every relevant detail of your business goal should be defined precisely. · Measurable: Quantifiable indicators will. Answer Created with AI. 5 months ago. SMART Goal Explanation A SMART goal is a To Mildred and the team, a logistics and supply chain management strategy. This goal should encompass skills such as negotiation, strategic thinking, data analysis, supplier relationship management, and market intelligence. By. Learn more about Smart Management: SMART Goals - Setting Effective Targets for Success Course at Vector Solutions Distribution Logistics. Distribution &. The goal-setting strategy known as SMART, which stands for setting goals that are Specific, Measurable, Attainable, Relevant and Time-Sensitive. In project management, SMART goals are specific, measurable, achievable, relevant, and time-bound objectives that guide project planning and execution. They. The first goal for any logistics company is to deliver value through a quality service. This requires building a large contact list of freighters. A counterexample of a SMART objective in logistics might be "Improve delivery efficiency". Although at first glance this objective may seem reasonable, it does. 12 SMART Goals Examples for Logistics Managers. Logistics managers must have a concrete framework to reach success. Read more for 12 examples of. Once you've identified your focus areas, it's time to set specific, measurable, achievable, relevant, and time-bound (SMART) goals for each category. For. All operations related to logistics aim to ensure that demand is satisfied (fulfilling goals), irrespective if it is a part made available to a manufacturer or. Specific: A specific goal has a much greater chance of being accomplished than a general goal. To set a specific goal you must answer the six “W” questions. SMART goals encourage you to focus on activities rather than outcomes. · Specific: I will pack (shorts, t-shirts, swim suit, sunscreen and flip-flops). measurable procurement objectives benefits Setting clear and measurable procurement goals is vital for organizations aiming to optimize supply chain. By now, entire generations of employees in businesses and institutions have grown up with the SMART principle. Goals must be Specific, Measurable, Acceptable. Specific, Measurable, Achievable, Relevant, Timely = SMART. SMART goals are a simple tool that will take you past fuzzy goal setting. Goal Setting Strategies for Freight Brokers & Agents · Specific · Measurable · Attainable · Relevant · Time bound. So what are your goals? Do you want to become. It makes our goals Specific, Measurable, Attainable, Realistic, and Time-Bound. SMART Goals are a tool that can be applied in many settings. For example, SMART. Establish specific, measurable, achievable, relevant, and time-bound (SMART) goals that align with your long-term career objectives in logistics and procurement.

Etf Expense Ratio Calculator

For ETFs and mutual funds, enter the investment symbol and current value. Our calculator will automatically fetch the corresponding expense ratio. For. The total expense ratio (TER) expresses the costs necessary to run a fund as a percentage. Expense Ratio Impact Calculator ; Initial Investment. $ ; Annual Periodic Investment. $ ; Annual Expected Investment Return. % ; Expense Ratio. % ; Investment. Retirement expense worksheet. Use this calculator to create a realistic retirement budget that includes basic and discretionary expenses. Calculate your. Fund fees and costs. Help on fund fees and costs: Fee and cost information can be found in the PDS or your fund's website. Exchange traded funds (ETFs). Sort the results by name, annual expense ratio, or fund category by clicking on the column headers. Save funds to your Favorite Funds list by clicking the heart. Easily compute the cost of your ETFs with our Expense Ratio Calculator. A must-have tool for investors, it helps you understand the annual fees taken from. Most ETFs have low expenses compared to actively managed mutual funds. ETF expenses are usually stated in terms of a fund's OER. The expense ratio is an annual. As each fund passes its fiscal year-end, the annual expense ratio is calculated by dividing the fund's operational expenses by its average net assets. If the. For ETFs and mutual funds, enter the investment symbol and current value. Our calculator will automatically fetch the corresponding expense ratio. For. The total expense ratio (TER) expresses the costs necessary to run a fund as a percentage. Expense Ratio Impact Calculator ; Initial Investment. $ ; Annual Periodic Investment. $ ; Annual Expected Investment Return. % ; Expense Ratio. % ; Investment. Retirement expense worksheet. Use this calculator to create a realistic retirement budget that includes basic and discretionary expenses. Calculate your. Fund fees and costs. Help on fund fees and costs: Fee and cost information can be found in the PDS or your fund's website. Exchange traded funds (ETFs). Sort the results by name, annual expense ratio, or fund category by clicking on the column headers. Save funds to your Favorite Funds list by clicking the heart. Easily compute the cost of your ETFs with our Expense Ratio Calculator. A must-have tool for investors, it helps you understand the annual fees taken from. Most ETFs have low expenses compared to actively managed mutual funds. ETF expenses are usually stated in terms of a fund's OER. The expense ratio is an annual. As each fund passes its fiscal year-end, the annual expense ratio is calculated by dividing the fund's operational expenses by its average net assets. If the.

If trades of the fund or ETF create a fee, such as for ETFs Average expense ratios for each subset of funds are shown alongside your fund's expense ratio. An ETF's expense ratio indicates how much of your investment in a fund will be deducted annually as fees. A fund's expense ratio equals the fund's operating. The management expense ratio (MER), or expense ratio, is the fee that must be paid by shareholders of a mutual fund or exchange-traded fund (ETF). Fees, as measured by a fund's management expense ratio (MER) are embedded in a fund's results. Therefore, a fund's return is net of fees. In this calculator. How much will that added expense ratio potentially hurt your investment growth? Find out here with our interactive Expense Ratio Calculator! A graphic explaining the expense ratio formula: Expense ratio equals management fees divided by total. Image source: The Motley Fool. Expense ratios are charged. Since a direct plan doesn't involve an intermediary, you don't pay any commission, which reduces the expense ratio and translates to relatively higher returns. The expense ratio is calculated by dividing a fund's net expenses by its net assets. The Bottom Line. Expense ratios are taken from mutual fund and ETF returns. How Is an ETF Expense Ratio Calculated? ETFs and other investment funds typically calculate the annual expense ratio by dividing the fund's operational. Interest Calculator | Average Return Calculator | ROI Calculator An ETF fund can be purchased or sold on a stock exchange the same way as a. Trading Expense Calculator. Use this tool to compare the potential costs of using ETFs or no-load mutual funds. (Some mutual funds are sold with a front-end. Use this free, easy-to-use calculator to so how investment fees can add up over time. ETFs and other investment funds typically calculate the annual expense ratio by dividing the fund's operational expenses by its average net assets. So if an ETF. Most ETFs have low expenses compared to actively managed mutual funds. ETF expenses are usually stated in terms of a fund's OER. The expense ratio is an annual. Compare ETFs and mutual funds. Select up to Use this calculator to create a realistic retirement budget that includes basic and discretionary expenses. ETF Cost Calculator. Calculate your personal investment fees. Calculate how much you can save by investing with ETFs. Obseerve the effect of interest rate. The SIP calculator does not provide clarification for the exit load and expense ratio (if any). This calculator will calculate the wealth gain and expected. If you want to learn more about ETF expense ratios, then you're in the right place. An ETF's expense ratio indicates how much of your investment in a fund will. By entering a few pieces of information, found in the fund's prospectus, view the impact of fees and operating expenses on the investment. Recovery Expense Fund · List of Debt Restructured ISIN · List of Holidays · Clean ETF Calculator. Security Name. AXISGOLD, BANKBEES, BIRLA SUN LIFE GOLD.

Do Timeshares Ever Make Sense

Does it Make Sense to Buy a Timeshare? · Generally, the tax benefits of putting money into a timeshare are limited. · You may be able to deduct property tax if. No, it's never a good idea to buy a timeshare. The math simply doesn't work in your favor. The never ending maintenance fees and the transfer. A timeshare is not an investment. Investments are designed to appreciate in value, generate income, or do both. A timeshare is unlikely to do either, despite. If you're looking to buy a fixed week rather than points, it's important to look for a week that makes the most sense to you. If you plan to travel to. They're a big commitment, but only if you don't plan on using your timeshare every year. If you want to vacation each year then timeshares are worth it. Besides. I want to travel to maldieves, Bali and south africa in the next 1 years does it make sense to just buy points off ebay and finish this trip? Regardless of what the company tells you, timeshares lose value and are often sold for pennies on the dollar (many sell for just $1 on eBay). That's because. When buying a timeshare many people are confused with one a question. Does it make economical sense or does it make sense at all to buy a timeshare? Well. They're a big commitment, but only if you don't plan on using your timeshare every year. If you want to vacation each year then timeshares are worth it. Besides. Does it Make Sense to Buy a Timeshare? · Generally, the tax benefits of putting money into a timeshare are limited. · You may be able to deduct property tax if. No, it's never a good idea to buy a timeshare. The math simply doesn't work in your favor. The never ending maintenance fees and the transfer. A timeshare is not an investment. Investments are designed to appreciate in value, generate income, or do both. A timeshare is unlikely to do either, despite. If you're looking to buy a fixed week rather than points, it's important to look for a week that makes the most sense to you. If you plan to travel to. They're a big commitment, but only if you don't plan on using your timeshare every year. If you want to vacation each year then timeshares are worth it. Besides. I want to travel to maldieves, Bali and south africa in the next 1 years does it make sense to just buy points off ebay and finish this trip? Regardless of what the company tells you, timeshares lose value and are often sold for pennies on the dollar (many sell for just $1 on eBay). That's because. When buying a timeshare many people are confused with one a question. Does it make economical sense or does it make sense at all to buy a timeshare? Well. They're a big commitment, but only if you don't plan on using your timeshare every year. If you want to vacation each year then timeshares are worth it. Besides.

A timeshare is a property with a divided form of ownership or use rights. These properties are typically resort condominium units, in which multiple parties. The key with timeshares is you've got to use them. And you've got to keep up with the latest developments, do your homework, and be willing to make the choice. A timeshare is not an investment. Investments are designed to appreciate in value, generate income, or do both. A timeshare is unlikely to do either, despite. So let's get this straight: Timeshares are not a way to make money. In fact, they're not a way to break even. Sure, they're a way for you to vacation with your. There are few buyers looking to purchase a timeshare in the after-market, which makes them very difficult to sell. The bottom line: You will likely lose money. Moreover, with the growth and increased regulation of the resale market, buying timeshares has become more accessible than ever. In short, today's timeshare. Buyer Beware · Timeshare salesmen are very good at what they do. · When you are on vacation, your guard can be down. · The Timeshare property they. I own two timeshares and they are not and investment in any financial sense of the word. For me they were worth the purchase because we know exactly what unit. Do Vacation Club Memberships Make Sense For You? His next question was “Is this kind of ownership for you?” Well, Martin's very skilled presentation did make. do it. I don't want to own the equipment either. It makes financial sense. So, even if I'm inside watching TV and hanging with my family, it's money well. Moreover, with the growth and increased regulation of the resale market, buying timeshares has become more accessible than ever. In short, today's timeshare. Timeshares are often thought of as very luxurious and accommodating vacations. Timeshare salespeople make the pitch the vacation can even end up costing you. When buying a timeshare many people are confused with one a question. Does it make economical sense or does it make sense at all to buy a timeshare? Well. The problem is that timeshares aren't as amazing as the salesperson claims they are. They are expensive, you probably won't use them as much as you think. Buyer Beware · Timeshare salesmen are very good at what they do. · When you are on vacation, your guard can be down. · The Timeshare property they. Though a Realtor will do better for you than an eBay listing, they likely will not be able to help you make a profit on your unit because the secondary market. in the past, i tried my one week time share on airbnb, but did not rent it out. How did it turn out for you? I thought that it only make sense if you have. Doing that once every two years has made financial sense for us The circumstances in which a timeshare makes sense is extremely thin. In summary, If you vacation, timeshare makes great financial sense while offering superb facilities. It also is the perfect means to help achieve the most. No need for Airbnb or VRBO since the timeshare company will rent out his weeks (at a fee of course). How can this be a profitable? I can't make the math work.

Best Stock Application

Schwab's stock trading app for mobile devices help you stay connected to the markets. Place trades, monitor stocks, and take a custom watch list wherever. 6 best stock APIs · Finnhub Stock API · Morningstar stock API · Xignite API · Bloomberg API · Google sheet finance · Exegy. Market pulse is the best application which is only available on google play store is the best app for analyses stock market in your phone. · In. MetaStock is an award-winning charting software & market data platform. Scan markets, backtest, & generate buy & sell signals for stocks, options & more. Zerodha - India's biggest stock broker offering the lowest, cheapest brokerage rates for futures and options, commodity trading, equity and mutual funds. Schwab Stock Slices™ · Schwab Personalized Indexing™ · Generating Retirement Forbes Best Customer Service was given on November 16, , and. Learn about the Best Trading Apps in India- · PayTm Money · Zerodha Kite · Angle One App · Upstox Pro Trading app · Groww App · 5paisa App · ICICI Direct App. Trade online, through Power E*TRADE, or with our mobile apps. Market insights. Find your next opportunity. Get timely market analysis, plus free Morgan Stanley. Robinhood has commission-free investing, and tools to help shape your financial future. Sign up and get your first stock free. Limitations and fees may. Schwab's stock trading app for mobile devices help you stay connected to the markets. Place trades, monitor stocks, and take a custom watch list wherever. 6 best stock APIs · Finnhub Stock API · Morningstar stock API · Xignite API · Bloomberg API · Google sheet finance · Exegy. Market pulse is the best application which is only available on google play store is the best app for analyses stock market in your phone. · In. MetaStock is an award-winning charting software & market data platform. Scan markets, backtest, & generate buy & sell signals for stocks, options & more. Zerodha - India's biggest stock broker offering the lowest, cheapest brokerage rates for futures and options, commodity trading, equity and mutual funds. Schwab Stock Slices™ · Schwab Personalized Indexing™ · Generating Retirement Forbes Best Customer Service was given on November 16, , and. Learn about the Best Trading Apps in India- · PayTm Money · Zerodha Kite · Angle One App · Upstox Pro Trading app · Groww App · 5paisa App · ICICI Direct App. Trade online, through Power E*TRADE, or with our mobile apps. Market insights. Find your next opportunity. Get timely market analysis, plus free Morgan Stanley. Robinhood has commission-free investing, and tools to help shape your financial future. Sign up and get your first stock free. Limitations and fees may.

Invest and build wealth with Stash, the investing app helping over 6M Americans invest and save for the future. Start investing in stocks, ETFs and more. Make investing moves on the go · Trade US stocks, commission-free with no account fees or minimums for brokerage accounts · Create savings goals and track your. This includes products such as stocks, bonds, currencies, commodities, derivatives and others, with a financial intermediary such as brokers, market makers. This article delves deep into the best stock charting apps available today, detailing their benefits, features, and much more to help you make an informed. Looking for an Indian Stock Market app with advanced features? Upstox is the one for you! Join Cr+ users growing their wealth right on Upstox! A platform tailored to you · Save and keep track. Use custom favourite lists to save stocks, stay on top of the news and document your thoughts in notes. A. For Stock Traders · For Options This interactive livestream reviews the day's trading, news, and events, helping you make the best informed decisions. Top 10 Broker Apps to Boost Trading ; ProStocks Star, ProStocks ; 1, Groww, Groww ; 2, Kite, Zerodha ; 3, AngelOne Super, Angel One. Application Security · Confidentiality Discount brokerage platforms mainly have services for trading and investment in the stock market and mutual funds. Online stock trading and investing platform for Stocks, F&O, Commodity, ETFs, Mutual Funds and IPO - Start online trading in stock market with Dhan! Stocks · Retirement Planning · Cryptocurrency · Best Online Stock Brokers · Best Investment Apps · View All · Mortgages. Mortgages. Homeowner Guide · First-Time. Boost your Shopify store with apps for Stock alerts. Discover the latest free and premium apps on the Shopify App Store. stocks, options, futures, currencies, bonds and funds. Transparent, low commissions and financing rates and support for best execution. Robinhood is the popular stock trading app for traders and investors to keep an eye on stocks and their ups and downs. It is also a hot startup idea. What effect will it have on best execution and its reporting to investors? What is the effect of exchanges allowed to adjust, in real time, dark exchange. Alpaca's easy to use APIs allow developers and businesses to trade algorithms, build apps and embed investing into their services. Jargon-free courses, paired with the web's best virtual stock market. Practice how to buy stocks under real market conditions. Our program lets people buy. In addition to real-time stock quotes, you'll find detailed information on Contact Us. Investor Relations · Contact · Careers · Advertise · Mobile Apps. Trade online, through Power E*TRADE, or with our mobile apps. Market insights. Find your next opportunity. Get timely market analysis, plus free Morgan Stanley. 10 Best AI Stock Trading Bots · 1. Trade Ideas · 2. TrendSpider · 3. Signm · 4. Signal Stack · 5. Stock Hero · 6. Tickeron.

1 2 3 4 5 6